SBF & the Suspicious Activities via FTX: Is this a Ponzi Scheme or Fraud?

FTX Group of Companies: The Backbone and Structure

Orchestrated and controlled by the mastermind Sam Bankman-Fried, these companies were set up or acquired one by one from year 2017, for various business objectives complementing one another.

Alameda

2017

Set up as a crypto trading firm and research house. Also played the role of market maker for FTX on especially on its native token FTT.

FTX.com

May 2019

Founded as a crypto centralized exchange (CEX), and also provided derivatives trading for the global retail market.

Blockfolio

August 2020

A cryptocurrency portfolio tracking app which was rebranded to FTX in July 2021.

FTX Ventures

January 2022

Venture capital arm of the group of companies, with a strong preference to invest in fintech, DeFi and GameFi.

FTX.us

February 2022

Due to stringent regulations in the US, this CEX is set up in compliance to serve US-based customers the same way as FTX.com.

FTX Japan

June 2022

Following the move in the US market, FTX started serving the Japanese market with in compliance with local laws and regulations.

Acquisitions and Investments by FTX

The FTX group of companies also invested into and/or acquired external projects or organizations, some of the notable ones include:

Other projects invested by the FTX group

What Happened to the FTX Exchange?

The former top crypto centralized exchange had its fishy financial positions exposed, and all hell broke loose from there.

Suspicious Alameda-FTX Insider Trading Revealed

CoinDesk that revealed that Alameda Research held a position worth $5 billion at the material time in the form of FTT, the native token of FTX. With the crypto winter ongoing, the value of FTT was also tumbling down. In other words, Alameda may not have sufficient reserves to pay its creditors.

2 November 2022

Binance Contemplates Exiting its Investment in FTX

Binance tweeted that it be selling off its holdings of FTT, which was worth $580 million back then. This triggered a sell-off of FTT and dragging the entire market down with it. To salvage the situation, FTX signed a non-binding agreement to sell the ownership of its business to Binance, which Binance subsequently withdrew from. Meanwhile, the US SEC and DOJ had begun to investigate the FTX collapse.

6-9 November 2022

Non-Fiat Withdrawals Halted in FTX, FTX US and FTX Japan

In the midst of a ding-dong situation between Binance and FTX, the group of companies begun halting and freezing withdrawals. FTX founder Sam Bankman-Fried tweeted his apologies on the halt, promising more transparency as an effort to maintain customer confidence as well as the social image of the exchange.

8-11 November 2022

Beginning of the End: FTX Files for Bankruptcy

The FTX group of companies filed for bankruptcy under Chapter 11 of the US Bankruptcy Code. Although most Chapter 11 bankruptcies allowed businesses to operate while debts are being restructured, the court appointed a trustee to manage the bankruptcy proceedings of FTX as fraud was involved. At such crucial times, Sam Bankman-Fried stepped down and John J. Ray III was conveniently appointed as the new CEO of FTX.

11 November 2022

Withdrawal Freeze Followed by Sums Evaporated into Thin Air

More freezes followed the Chapter 11 bankruptcy. While withdrawals were subsequently resumed, more than $600 million was reported to have disappeared from FTX user wallets, raising even more questions among customers and the crypto community. In response to such suspicious reports, FTX claims via Telegram that its platform has been hacked.

8-11 November 2022

More Alameda-FTX Dirty Laundry Exposed

The Wall Street Journal reported that FTX lent its customers’ funds to Alameda Research, as a move to help Alameda with its trading operation. It was also evident the top executives of both organizations, including Sam Bankman-Fried of FTX and Caroline Ellison of Alameda Research, are well aware of this arrangement.

12 November 2022

Industry Impact of the FTX Incident

Too much of fraud-like trails of the leading CEX being exposed has added more FUD to the existing negative sentiment of the ongoing crypto winter. Notably, the crypto market tanked below critical price levels, with the tokens below being affected the most.FTX (FTT)

Naturally, being the native token of the centralized exchange, FTX (FTT) suffered a loss from $22.1203 to $2.1045, resulting in a loss of -90%.

The current price of FTX (FTT) is $0.7317, which is also -0.03% in the last 24 hours, and -0.24% in the past 7 days. For more information, see FTX (FTT) price now.

Trade FTT/USDTSolana (SOL)

As the Serum Consortium was one of the substantial investors which included FTX, Solana (SOL) also suffered a loss from $29.619 to $14.579, resulting in a loss of -51%.

The current price of Solana (SOL) is $131.83, which is also -0.02% in the last 24 hours, and -0.18% in the past 7 days. For more information, see Solana (SOL) price now.

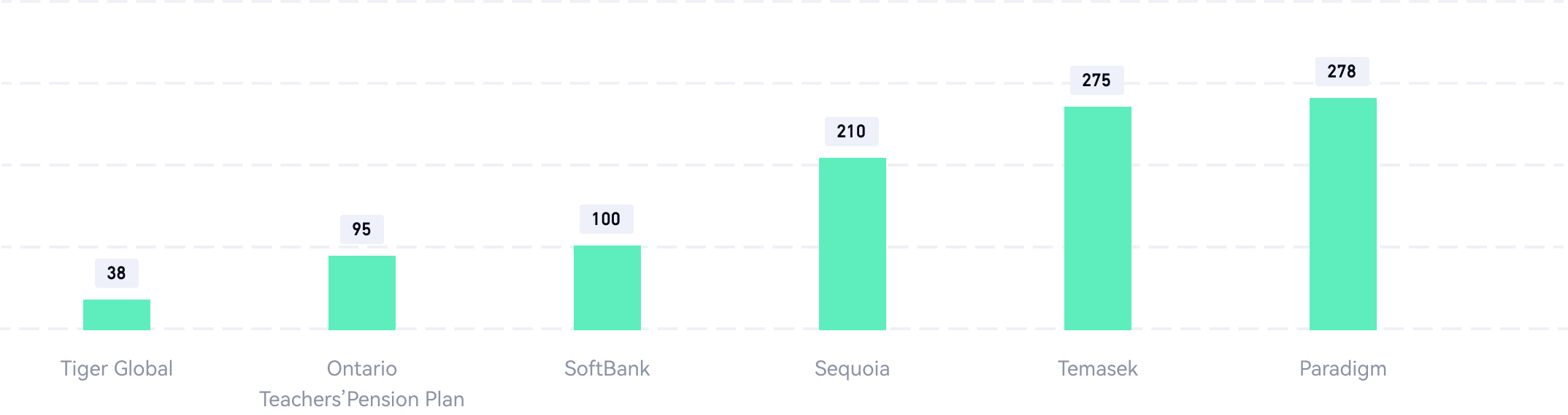

Trade SOL/USDTFTX Investors who Suffered Losses in Millions

Apart from retail customers of FTX, Sam Bankman-Fried had also painted an all-rosy picture for the institutional investors,

and they unfortunately had to pay a hefty price tag for such an investment decision. Some of the investors include:

Lessons Learnt from the FTX Crash

It is difficult to imagine that even a leading crypto centralized exchange with one of the highest trading volume and best social recognition could tank the way FTX did. Evidently, most crypto investors have neglected these important aspects of crypto.

There are pros and cons of holding cryptos in the centralized exchanges (CEX)

Understanding the differences between CEX and DEX, and choose your crypto platforms appropriately

Consider using cold wallets as part of risk mitigation

Proof of Reserves is important for the safety of users' assets

Sam Bankman-Fried to Face Legal Proceedings

After wrecking the market havoc, Sam Bankman-Friend became one of the most suspicious individual. Legal proceedings of both civil and criminal nature await the mastermind, while the Chapter 11 bankruptcy proceedings continue concurrently.

SBF to Testify in a Hearing

Likely to be key individuals to the FTX incident, the US house lawmakers called on Sam Bankman-Fried as well as executives at Alameda and Binance to testify in a hearing.

16 November 2022

Trouble in Heaven: SBF Arrested in Bahamas

After the New York federal prosecutors filed the criminal charges contained in a sealed indictment against Sam Bankman-Fried, he was arrested in the Bahamas.

12 December 2022

A Long List of Criminal Charges for SBF

This included two counts of wire fraud conspiracy, two counts of wire fraud, one count of conspiracy to commit money laundering, conspiracy to commit commodities fraud, conspiracy to commit securities fraud, conspiracy to defraud the US and commit campaign finance violations. With that, the maximum jail sentence can be up to 115 years.

13 December 2022

Nowhere to Hide: The Court Appearance of SBF

With multiple counts of criminal charges stacked on him, Sam Bankman-Fried was brought back to the US and made the first US court appearance.

22 December 2022

Freedom is Expensive: SBF Released on a Bond

Sam Bankman-Fried was released on a $250 million bond, the biggest bond amount ever recorded in the history of US.

23 December 2022

More Legal Liabilities Await: Civil Class Action Suit Against FTX and SBF

FTX customers jointly initiated civil legal proceedings in the form of a class action lawsuit to seeking to recover assets and funds.

28 December 2022

FAQ: All About the FTX Incident and Sam Bankman-Fried

Who is Sam Bankman-Fried (SBF)?

Is the FTX crash a Ponzi scheme?

What are the legal repurcussions on SBF for the fraudulent activities that he has been carrying out since 2017?

Can FTX investors and users get their money back?

What is Proof of Reserves?

Is Solana still a good investment given that the FTX crash has dragged Project Serum down with it?

How to buy Solana if it is believed to still be a good investment?

FTX Incident Related Articles

24/7/365 Customer Support

Should you require assistance related to Gate products and services, please reach out to the Customer Support Team as below.Disclaimer

The cryptocurrency market involves a high level of risk.Users are advised to conduct independent research and fully understand the nature of the assets and products offered before making any investment decisions. Gate shall not be held liable for any loss or damage resulting from such financial decisions.Further, take note that Gate may not be able to provide full service in certain markets and jurisdictions, including but not limited to the United States of America, Canada, Iran and Cuba. For more information on Restricted Locations, please refer to Section 2.3(d) of the User Agreement.

Start NowSign up and get a $100 Voucher!Create Account