November 2025 Crypto Summary: Institutional Adoption and Market Dynamics

November 2025 Crypto Summary: Institutional Adoption and Market DynamicsWith Hong Kong launching its tokenized deposit pilot, the transformation of digital financial infrastructure is accelerating. Meanwhile, Tether is expanding its influence in the crypto and technology sectors through both its investment in Ledn and a potential $1.15 billion stake in Neura Robotics. El Salvador increased its reserves by executing the largest single-day Bitcoin purchase in history, while Japan reduced crypto taxation from 55% to 20%, offering a more investor-friendly framework. Metaplanet is expanding its Bitcoin-focused treasury model, and Vitalik Buterin highlights the growing impact of institutional funds on Ethereum. In the U.S., Michael Selig’s nomination for CFTC chairman moves to a Senate vote, while Solana ETFs continue strong entries and Bitcoin ETFs break the previous outflow trend, indicating a renewed strength in institutional demand.

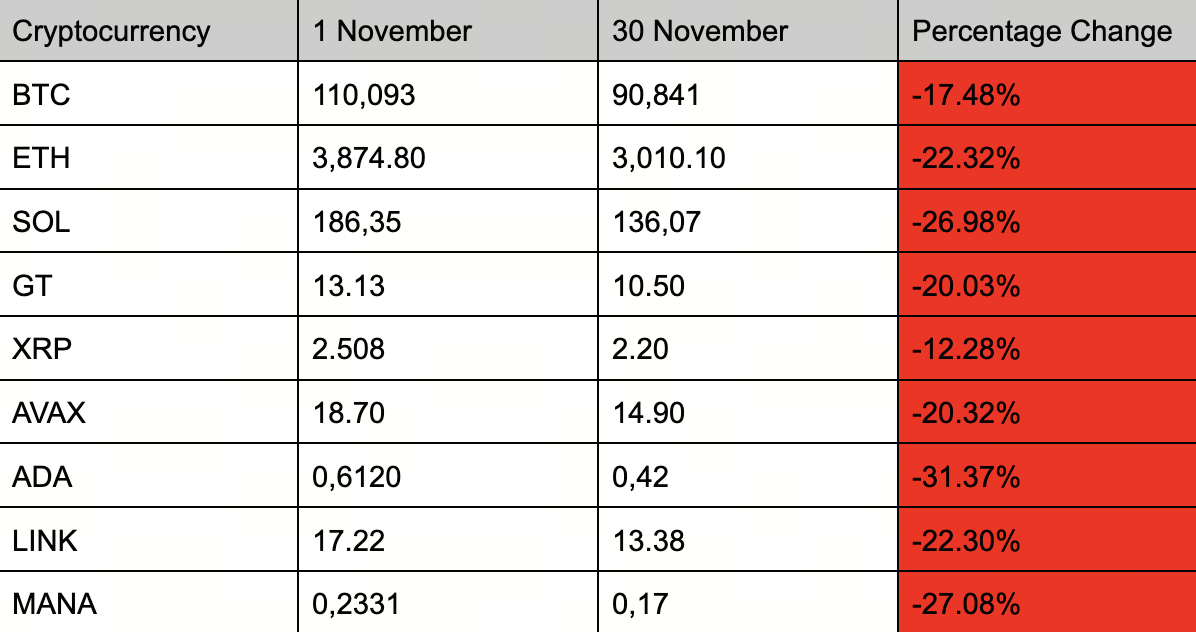

Price Changes of Major Cryptocurrencies in November

November 2025 Crypto Agenda: Key Developments

Hong Kong Launches EnsembleTX Pilot

Hong Kong accelerated its transition to blockchain-based financial infrastructure by launching the EnsembleTX pilot program, which tests tokenized deposits and real-value transactions with digital assets.

Tether Makes Strategic Investment in Ledn

Tether, one of the largest companies in the digital asset sector, announced an investment in Ledn, a global leader in Bitcoin-backed loans.

Japan Reduces Crypto Tax from 55% to 20%

Japan plans to align cryptocurrency taxation with stock taxation, lowering rates from up to 55% to a fixed 20%, creating a more investor-friendly environment.

Metaplanet Expands Bitcoin-Based Treasury Model

Metaplanet is raising new capital to expand its Bitcoin-focused treasury strategy and is issuing special preferred shares to overseas investors.

Vitalik Buterin Warns About Institutional Funds

Ethereum co-founder Vitalik Buterin cautioned that large institutional investors, such as BlackRock, accumulating Ethereum in bulk could negatively affect the network’s values.

Selig’s CFTC Chair Nomination Moves to Senate Vote

Michael Selig’s nomination for Chairman of the U.S. Commodity Futures Trading Commission cleared the committee stage and has moved to a full Senate vote.

Record Inflows into Solana ETFs

Despite the decline in SOL prices, spot Solana ETFs have received inflows for 17 consecutive days, totaling $476 million in net inflows.

Hong Kong Advances Toward Crypto Hub with Real-Value Tokenized Transactions

Hong Kong continues to progress toward becoming a crypto hub by testing real-value tokenized transactions, further integrating blockchain-based finance into its infrastructure.

Hong Kong SFC Authorizes Licensed Crypto Exchanges to Share Global Order Books

On November 3, 2025, the Hong Kong Securities and Futures Commission (SFC) issued a new circular allowing licensed Virtual Asset Trading Platforms (VATPs) to integrate and share their global order books with overseas exchanges.

Scope and Purpose

Under the circular, SFC-licensed platforms can now operate a shared order book mechanism, enabling identical order and trade data to be reflected both domestically and across affiliated international venues. This move aims to enhance market liquidity, improve price discovery, and reduce transaction costs.

However, such integration requires prior written approval from the SFC. Exchanges must provide access to shared order book data “immediately upon request” and remain under the regulator’s supervision for execution and client protection.

Why It Matters

Liquidity fragmentation has long hindered efficient crypto price formation. By linking order books across jurisdictions, Hong Kong may pioneer a more cohesive and transparent global trading environment. This policy aligns with Hong Kong’s broader ambition to position itself as Asia’s leading crypto-financial hub, complementing its recent reforms on stablecoin listing requirements. While the initiative marks a leap forward in regulated innovation, its success will depend on careful oversight to ensure market fairness, transparency, and compliance.

European Commission Moves Toward a “European SEC” by Expanding ESMA’s Powers

The European Commission is preparing a sweeping financial reform package, set for late 2025, aimed at centralizing financial supervision across the bloc. The proposal seeks to significantly expand the European Securities and Markets Authority’s (ESMA) mandate, potentially transforming it into an EU-wide supervisory body akin to the U.S. Securities and Exchange Commission (SEC).

Strategic Rationale

Currently, financial oversight in the EU remains fragmented among national regulators, creating inefficiencies in cross-border investment and capital markets integration. The Commission’s “Capital Markets Union” initiative intends to harmonize regulatory frameworks and enhance oversight consistency.Under the plan, major exchanges, crypto-asset service providers (CASPs), and post-trade infrastructures could fall directly under ESMA’s authority. This shift would move from a nationally segmented system to a unified regulatory architecture.

Impact on the Crypto Sector

For crypto businesses, the proposed model implies stricter, pan-European supervision beyond the existing MiCAframework. Instead of multiple local licenses, companies could operate under a single EU authorization.

Challenges and Diverging Views

Not all member states welcome centralization. Malta and several smaller jurisdictions advocate for retaining flexibility in their domestic regulatory environments. ESMA’s leadership also acknowledged that achieving consensus across all members “will take time.”

Outlook

Expected in December 2025, the “Markets Integration Package” will outline new supervisory powers, coordination mechanisms, and funding resources.If enacted, it could mark a turning point for Europe’s financial and crypto ecosystems—promising greater investor protection and cross-border efficiency, while posing challenges in regulatory compliance and sovereignty.

TÜİK: Turkish Producer Prices Up 1.63% Monthly, 27.00% Annually in October 2025

According to the Turkish Statistical Institute (TÜİK), the Domestic Producer Price Index (PPI) rose 1.63% month-over-month and 27.00% year-over-year in October 2025.

Interpretation and Economic Implications

The continued increase in producer prices highlights persistent cost pressures stemming from energy, currency fluctuations, and supply chain constraints.While monthly gains show a mild acceleration from September, the high annual rate signals that inflationary pressures remain entrenched in the production pipeline.

Broader Macroeconomic Impact

- Inflation expectations: Rising producer prices often translate into higher consumer prices (CPI) in subsequent months.

- Monetary policy: The central bank may consider further tightening to curb cost-push inflation.

- Corporate margins: Persistent cost increases risk squeezing profit margins for producers.

- Exchange rate sensitivity: Given Turkey’s import-dependent manufacturing structure, currency depreciation amplifies producer inflation.

Overall, the 27% annual rise underscores sustained inflationary dynamics, warning of ongoing cost pressures across the economy.

Tether Reports $10 Billion Net Profit and $6.8 Billion in Excess Reserves for 2025 YTD

Stablecoin leader Tether announced over $10 billion in year-to-date net profit by the end of Q3 2025, along with $6.8 billion in surplus reserves, marking one of its strongest financial performances to date.

Financial Highlights

- Total reserves reached $181.2 billion, backing roughly $174 billion in circulating USDT.

- U.S. Treasuries accounted for $135 billion of Tether’s holdings, placing it among the largest private holders of U.S. government debt.

- Independent attestations confirmed the company’s balance strength and transparency.

Significance

Tether’s exceptional profitability underscores the growing global demand for stablecoins as liquidity instruments. The company’s diversified reserve portfolio—spanning treasuries, gold, and Bitcoin—further enhances its resilience against market shocks.

Strategy Inc. Raises $69.5 Million Through Stock Sales to Fund Bitcoin Acquisitions

Between October 27 and November 2, 2025, Strategy Inc. (MSTR) sold approximately $69.5 million worth of stock via at-the-market (ATM) offerings.

Context and Implications

The firm, known for its aggressive Bitcoin investment strategy, continues leveraging equity sales to expand its Bitcoin holdings.While such sales may temporarily dilute shareholders, they reinforce the company’s unwavering commitment to a Bitcoin-centric treasury model.

Market analysts view this as a signal of institutional conviction in Bitcoin’s long-term value, though it may also reflect short-term liquidity management needs.

Canada Unveils C$141 Billion Budget to Counter U.S. Trade Tariffs

The Canadian government introduced a C$141 billion (≈ USD 100 billion) fiscal package to offset the economic strain from new U.S. trade tariffs and stimulate domestic growth.

Key Components

- C$50 billion for infrastructure projects spanning energy, transport, and renewables.

- C$60 billion in public spending cuts aimed at balancing the fiscal deficit, projected at C$78.3 billion for 2025.

Context

The move follows U.S. President Donald Trump’s renewed tariff threats—particularly on Canadian steel and aluminum—posing significant risks to export-led sectors.

Impact

Economically, the budget aims to buffer Canada against reduced trade flows and declining private investment. Politically, it reflects the government’s determination to maintain economic sovereignty amid growing protectionism.

Senator Cynthia Lummis Advocates for a U.S. Strategic Bitcoin Reserve

Wyoming Senator Cynthia Lummis continues to push for the “BITCOIN Act of 2025”, proposing the creation of a Strategic Bitcoin Reserve (SBR) held under the U.S. Treasury.

Key Provisions

- Establishment of a sovereign Bitcoin reserve using seized or acquired BTC.

- Treasury-held cold storage facilities and public cryptographic attestations for transparency.

- Bitcoin to be treated as a strategic national asset, akin to gold, without increasing public debt.

Rationale and Criticism

Lummis argues that Bitcoin’s finite supply and global recognition make it a viable “digital gold.” However, critics warn of volatility, regulatory complications, and potential conflicts with the decentralized ethos of cryptocurrency. While the bill remains under review, it signals a profound ideological shift—embedding Bitcoin into national financial strategy.

Mastercard, Gemini, and Ripple Partner to Pilot Blockchain-Based Credit Card Payments

Mastercard, in collaboration with Gemini and Ripple, is preparing to pilot blockchain-settled credit card transactions—a milestone toward merging traditional finance with distributed ledger infrastructure.

Pilot Objectives

Transactions initiated via Mastercard cards will be settled through blockchain networks rather than conventional clearing systems.

Gemini will manage crypto liquidity and payment processing, while Ripple will power the blockchain infrastructure, likely using its On-Demand Liquidity (ODL) framework.

Significance

The pilot represents a step toward cost-efficient, faster, and globally interoperable payment rails. It also strengthens the fiat–crypto bridge, promoting blockchain adoption within regulated finance.However, scalability, regulatory compliance, and consumer transparency remain key challenges before mainstream implementation.

U.S. Spot Bitcoin ETFs Record $2 Billion in Weekly Outflows

Spot Bitcoin ETFs in the United States witnessed over $2 billion in net outflows during the week of October 27 – November 2, 2025, marking the second-largest withdrawal in ETF history.

Market Interpretation

The exodus was attributed to rising interest rates, a stronger U.S. dollar, and investor risk aversion amid sideways Bitcoin price action.These outflows may constrain liquidity in BTC markets, reflecting growing institutional caution.Despite short-term pressure, analysts note that such volatility underscores Bitcoin’s increasing integration into the broader macroeconomic landscape—where global monetary shifts now directly influence crypto investment flows.

Strong Start in Asian Markets on Hopes of U.S. Government Reopening

Asian markets began the week with a pronounced upward momentum, driven largely by optimistic news suggesting a potential reopening of the U.S. federal government. Following a prolonged budget impasse, the alleviation of shutdown risks significantly bolstered investor confidence. As global risk appetite rebounded, major indices across Asia recorded notable gains.

In Tokyo, the Nikkei 225 climbed more than 1% on the first trading day of the week, while South Korea’s KOSPI index, led by technology stocks, exhibited a robust recovery. China’s Shanghai and Shenzhen indices also trended upward, with local investor sentiment fueled by expectations of government measures to support economic growth.

Analysts noted that the reduction in political uncertainty in the U.S. eased global risk perceptions, prompting investors to reallocate toward higher-risk assets such as equities. A modest weakening of the U.S. dollar further supported Asian currencies and, by extension, regional equity markets. Experts emphasized that upcoming U.S. economic data and statements regarding the Federal Reserve’s monetary policy will be critical in determining the sustainability of this positive trajectory.

DTCC Lists Spot XRP ETFs

The United States’ largest clearing and depository institution, the Depository Trust & Clearing Corporation (DTCC), has taken a notable step in the cryptocurrency market by including five distinct spot XRP ETFs in its active and pre-launch fund listings. This development has generated significant excitement among crypto investors.

Renowned as one of the most reliable infrastructure providers in financial markets, DTCC’s listing of an ETF is typically viewed as one of the final steps before it becomes tradable on exchanges. This move signals that the long-awaited institutional adoption of XRP may be imminent.

Following the announcement, XRP prices responded positively, reflecting renewed market optimism. Analysts interpret DTCC’s action as a pivotal milestone in the broader integration of cryptocurrencies into the traditional financial system. The inclusion of XRP, following Bitcoin and Ethereum ETFs, reinforces expectations of increasing institutional interest across the altcoin market.

Experts assert that this development is not only significant for XRP specifically but also serves as a legitimacy indicator for the crypto ecosystem as a whole. The progress in the long-standing legal dispute between Ripple and the U.S. Securities and Exchange Commission (SEC) further bolsters investor confidence. Should these ETFs receive formal approval, XRP’s market capitalization is expected to experience substantial growth.

Record Streak for Solana ETFs: Ten Consecutive Days of Net Inflows

Spot Solana ETFs, closely monitored by cryptocurrency markets, recorded net inflows for the tenth consecutive day on Monday, signaling robust investor interest. On the last trading day, these funds attracted an additional $6.78 million in fresh capital, reflecting growing institutional confidence in Solana.

This momentum particularly underscores the rising attention toward next-generation smart contract platforms following the adoption of Bitcoin and Ethereum ETFs. Known for its high transaction speed and low fees, Solana has long been regarded as an “Ethereum alternative.” Continuous inflows into spot ETFs demonstrate investors’ reinforced belief in both Solana’s technical capabilities and its economic potential.

Experts note that this surge is not merely driven by price expectations but also serves as a significant indicator of institutional adoption of blockchain infrastructure. As regulatory uncertainty in the U.S. gradually diminishes, institutional funds appear increasingly willing to allocate a larger portion of their portfolios to Solana.

Analysts anticipate that these steady inflows into Solana ETFs could persist through the final quarter of the year, potentially triggering a sustained growth trend in Solana’s overall market capitalization. Furthermore, the expansion of DeFi and NFT projects within the Solana ecosystem is emerging as an additional factor supporting heightened institutional interest.

Tether Initiates Digital Transformation Collaboration with Da Nang City, Vietnam

Tether, a leading entity in the digital asset sector, has forged a significant agreement with Da Nang, one of Vietnam’s cities renowned for its technological vision. The company announced the signing of a Memorandum of Understanding (MoU) with the Da Nang City People’s Committee to collaborate on the development of digital infrastructure and innovative governance models.

This partnership is viewed as part of Tether’s broader ambition to spearhead digital transformation projects on a global scale. The company aims to expand its impact beyond stablecoin issuance, encompassing financial inclusion and the advancement of the digital economy. The collaboration with Da Nang is expected to promote the adoption of digital solutions and blockchain-based systems within municipal governance.

Tether officials emphasized that the project is not solely about building technological infrastructure but also about fostering a citizen-centric, transparent, and innovative approach to administration. Accordingly, Tether intends to leverage blockchain technology for urban planning, data security, identity verification, and more efficient delivery of public services.

In recent years, the Vietnamese government has made significant strides in digital transformation and fintech development. Da Nang, in particular, stands out as a leading region in technology startups, sustainable urban development, and digital governance. Consequently, Tether’s agreement with the city represents a strategic move with both local and global implications.

Experts assert that this initiative will enhance Tether’s global presence and play a pivotal role in integrating stablecoin technologies into real-world applications. Moreover, it serves as a compelling demonstration that blockchain-based financial systems can function not only as investment instruments but also as tools for modernizing public services.

Shock Allegation from China Against the U.S.

In a development that underscores the intersection of global geopolitical tensions and technology, China’s cybersecurity authority has accused the U.S. government of orchestrating an enormous Bitcoin theft. According to the National Computer Virus Emergency Response Center of China (CVERC), approximately $13 billion worth of Bitcoin was allegedly stolen through a “coordinated, systematic, and state-level” operation.

The center noted that the movement of the stolen Bitcoins across the blockchain was remarkably “silent and delayed.” This pattern deviates from typical cybercriminal behavior, suggesting a “professional operation executed with state support.” Chinese officials indicated that the transfers were concealed using sophisticated software tools, and they traced several IP addresses originating from the United States.

The announcement has the potential to intensify the already ongoing U.S.–China rivalry in technology and finance. While Washington has yet to provide an official response, U.S. analysts caution that the allegations may carry a “political motivation.” Meanwhile, Chinese media have portrayed the report as evidence of “external threats” to the nation’s digital sovereignty.

In recent years, China has increased its control over digital assets, banning cryptocurrency mining while continuing strategic investments in blockchain technology. Experts suggest that this latest development signals not just a cybersecurity debate but also a new phase in the struggle for economic power and digital sovereignty.

Some analysts believe that China aims to challenge the U.S.-centric dominance in global cryptocurrency markets through these accusations. Considering the impact of approved Bitcoin ETFs in the U.S. on global liquidity, these claims could be interpreted as a geopolitical countermeasure.

Record Inflows into U.S. Spot Bitcoin ETFs

Despite Bitcoin losing approximately 3% on Tuesday, U.S. spot Bitcoin ETFs witnessed unprecedented investor demand. Daily net inflows totaled $524 million, indicating that investors are maintaining their long-term confidence despite short-term price fluctuations.

A significant portion of these inflows originated from major funds such as BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC). Analysts attribute this phenomenon to institutional investors viewing market dips as “buying opportunities.”

Typically, crypto markets experience fund outflows during price declines; however, the current scenario presents the opposite. Investors appear to be confident that the institutional legitimacy provided by ETF approvals will bolster Bitcoin’s long-term value. Moreover, growing expectations of interest rate cuts in the U.S. have further fueled interest in risk assets.

Experts note that these inflows also underscore the role of spot ETFs in stabilizing Bitcoin prices. Traditional investors can now access Bitcoin through regulated financial products without relying on crypto exchanges, enhancing both market confidence and liquidity.

Some analysts caution that short-term volatility may persist, but the scale of these inflows could signal the onset of a new long-term bull cycle. The resilience of the ETF market, despite recent price swings, reflects a fundamental shift in institutional investors’ perception of the cryptocurrency ecosystem.

Taiwan Considers Establishing a National Bitcoin Reserve

A notable development in the cryptocurrency sphere has emerged from Asia, as the Taiwanese government is considering the creation of a national Bitcoin reserve composed of seized crypto assets. This initiative draws inspiration from the Strategic Bitcoin Reserve plan launched in the United States in March by former President Donald Trump.

Taiwan has increasingly distinguished itself through policies that simultaneously support blockchain technology and prioritize financial security. The growing volume of confiscated Bitcoins, resulting from measures against cybercrime and illicit crypto transactions, has prompted authorities to explore more strategic utilization of these assets.

According to reports, the Ministry of Finance and the Central Bank of Taiwan have established a joint working group to examine the potential use of the reserve as a tool for economic stabilization. The Bitcoin reserve is intended to complement the nation’s foreign exchange reserves and serve as a safeguard against future financial crises.

Experts argue that this move carries not only economic significance but also geopolitical strategy. Amid intensifying U.S.-China global competition, several Asian countries are increasingly considering digital assets as strategic reserve instruments. Taiwan’s initiative is therefore interpreted as both a step toward enhancing digital sovereignty and a demonstration of innovation in the international financial arena.

Some analysts caution that Bitcoin’s inherent volatility makes its use as a national reserve instrument a delicate matter. Nevertheless, Taiwanese officials emphasize that the reserve would be supplementary and not form the backbone of the national economy. If implemented, Taiwan would become the first Asian country to officially establish a Bitcoin reserve.

“Token Taxonomy” Set to Reshape Crypto Regulation

The U.S. Securities and Exchange Commission (SEC) is preparing to take a decisive step to resolve longstanding ambiguities in cryptocurrency regulation. SEC Chair Paul Atkins announced at the Federal Reserve’s Fintech Conference that the agency is developing a new classification system, termed the “token taxonomy.”

Atkins emphasized that the current framework fails to accurately reflect the nature of digital assets, generating considerable confusion over whether many tokens should be classified as securities or commodities. The new taxonomy aims to clearly delineate the legal status, function, and market role of each token type, thereby enhancing regulatory predictability for both investors and project teams.

The debate over how to classify crypto assets has persisted for years, particularly due to jurisdictional conflicts between the SEC and the Commodity Futures Trading Commission (CFTC). Atkins’ announcement is viewed as a concrete move to bring clarity to this regulatory deadlock.

Under the proposed system, tokens will be categorized according to their utility, economic model, and ownership structure. For instance, a token providing solely network access would be classified as a “utility token,” whereas one offering investment returns would fall under the “security token” category. This distinction is designed to promote fairer regulation while ensuring that innovative projects are not unduly constrained.

Industry representatives have generally welcomed this initiative, seeing a clear regulatory framework as a catalyst for investor confidence and increased institutional participation in the crypto market. However, some critics caution that practical implementation may take time and urge the SEC to maintain flexibility throughout the process.

Atkins clarified that the objective is not to suppress the industry but to “foster innovation through sound regulation.” The token taxonomy is expected to be opened for public consultation in the coming months before progressing to the legislative adoption phase.

Bank of Russia Opens the Door to Crypto

The Russian financial sector is on the verge of a historic shift. According to a senior official, the Bank of Russia (CBR) plans to permit investment funds to allocate assets to cryptocurrency derivatives starting in 2026. This development marks a notable softening in the country’s traditionally cautious stance toward digital assets.

Under current regulations, investment funds are completely barred from accessing crypto-linked financial instruments. However, the CBR intends to enact the necessary legal amendments in the first quarter of next year to lift this restriction. Olga Shishlyannikova, Director of the CBR’s Investment Finance and Intermediation Department, announced the plan at a finance forum in Yekaterinburg.

Shishlyannikova stressed that the existing framework impedes investment funds from leveraging innovative financial products. She stated, “Regulatory amendments are necessary. We plan to implement these changes in Q1 2025. The clause imposing the prohibition will be fully removed.”

The official also noted that a similar ban on brokers had been lifted in the past, but emphasized that the restrictions on investment funds can only be repealed through legal reform, not via administrative directives.

This announcement corroborates earlier statements by Valery Krasinsky, who first indicated that the CBR was considering steps in this direction. In September, Krasinsky remarked that the goal was to “level the playing field,” allowing investment funds to access crypto derivatives under the same conditions as brokers.

A Shift in Russia’s Cautious Crypto Stance

The Bank of Russia (CBR) has long been regarded as one of the most stringent financial authorities toward cryptocurrencies. However, recent developments indicate a marked shift in the country’s approach, as Russia increasingly leverages digital assets to circumvent Western sanctions and create alternative channels for international trade.

In May 2025, the CBR approved a framework allowing financial institutions to offer derivative products, digital securities, and financial instruments linked to the prices of major cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH). Following this decision, prominent institutions including Sberbank, the Moscow Exchange, and Finam swiftly launched Bitcoin futures and similar products.

Under the new plan, investment funds will also gain access to these markets. Certain limitations will remain: crypto derivatives will not entail the physical delivery of underlying assets and will be available exclusively to “highly qualified investors” meeting specific income and asset thresholds. Furthermore, existing products continue to operate under an “experimental legal regime.” The CBR aims to establish their full legal status through a comprehensive crypto investment law expected to take effect in 2026.

A Harbinger of a New Era?

This initiative is widely interpreted as the dawn of a new era in Russia’s cryptocurrency strategy. The country now views digital assets not as a threat but as potential economic instruments, aligning with its objective of maintaining financial sovereignty.

In October, CBR Deputy Chairman Vladimir Chistyukhin announced that new regulations would permit commercial banks to engage with cryptocurrencies. He emphasized that special risk management protocols would be implemented and strict security requirements would apply to all institutions.

These measures indicate that Russia is gradually integrating cryptocurrencies into its financial system. Experts anticipate that, with the new regulations expected in 2026, the country will advance rapidly toward establishing a “crypto-friendly financial framework.”

Ultimately, the CBR’s plan to allow investment funds to invest in crypto derivatives signals that Russia is not merely recognizing digital assets but is actively positioning them as strategic financial instruments.

Hong Kong Advances Toward a Crypto Hub with Real-Value Tokenized Transactions

The Hong Kong Monetary Authority (HKMA) has officially launched Ensemble¹TX, the latest phase of Project Ensemble. This initiative marks the testing of real-value (fiat-backed) transactions alongside tokenized deposits and digital assets in a pilot environment. According to HKMA, this represents a step beyond the proof-of-concept stage and a significant milestone in the transformation of financial infrastructure through tokenization.

The primary objective of Ensemble¹TX is to enable market participants to utilize tokenized deposits in real-world transaction scenarios, particularly in money market funds and liquidity/treasury management processes. HKMA has indicated that the pilot will run through 2026.

Initially, interbank tokenized deposit transfers will be conducted via the Real Time Gross Settlement (RTGS) system using the Hong Kong Dollar (HKD). Over time, HKMA plans to evolve the pilot environment into a structure where tokenized central bank money can operate 24/7.

Participating banks and institutions are collaborating within HKMA’s Architecture Community framework, with HSBC playing an active role. On November 13, 2025, HSBC successfully transferred a tokenized deposit belonging to Ant International to a “wallet” at another bank, completing the first live cross-bank transaction. Vincent Lau, head of HSBC’s Digital Currency division, stated that this development supports Hong Kong’s vision of becoming a global center for digital currency and asset innovation.

There is also close cooperation between HKMA and the Securities and Futures Commission (SFC). Within the Ensemble¹TX framework, SFC is working alongside HKMA to regulate tokenized asset classes and their use cases. The project could enhance both process efficiency and transparency; tokenized deposits could operate around the clock, and automation and programmable features could make liquidity management more dynamic for institutions. This initiative is also part of Hong Kong’s broader digital finance vision: a strategy to merge traditional banking systems with blockchain and build forward-looking financial infrastructure.

Tether Makes Major Move: $1.15 Billion Investment in Neura Robotics

Tether, issuer of one of the world’s largest stablecoins, is exploring a strategic move into AI and robotics, stepping beyond its traditional business model. The company is reportedly in discussions to invest approximately $1.15 billion in German robotics venture Neura Robotics.

Although negotiations are not yet finalized, this move could value Neura Robotics between €8 and €10 billion. Neura Robotics focuses on developing humanoid robots for both industrial and domestic applications, with plans to produce up to five million units by 2030. The company aims to create an “iPhone moment” in robotics.

For Tether, this investment is part of a strategy to channel strong cash flows from its stablecoin operations into advanced technology. CEO Paolo Ardoino envisions a future of “trillions of AI agents, billions of robots, and a shared ecosystem with humans.” This step could position Tether as not only a financial player but also an active technology investor.

However, the risks are substantial: the robotics sector is capital-intensive, highly competitive, and technologically uncertain. While potential returns are high, the investment would entail a long-tesrm transformation process.

El Salvador’s Historic Bitcoin Purchase

The El Salvador government grabbed global crypto headlines with a major Bitcoin acquisition on Monday evening. The country purchased 1,090 BTC in a single transaction, amounting to roughly $100 million, marking El Salvador’s largest single Bitcoin purchase to date.

This increased the nation’s total Bitcoin reserves to 7,474 BTC. President Nayib Bukele’s long-standing policy of regarding Bitcoin as a “national strategic asset” was reinforced through this aggressive move, executed during a brief price dip, signaling that the government views downturns as opportunities.

El Salvador’s Bitcoin strategy, initiated with BTC’s recognition as legal tender in 2021, continues to spark global debate. While the country had been gradually increasing reserves through daily acquisitions, this latest purchase far exceeds routine amounts.

The timing of this massive buy has sparked commentary. Some analysts suggest it reflects the government’s vision of a long-term Bitcoin reserve fund, while others debate the fiscal impact, considering El Salvador’s ongoing negotiations with international financial institutions and long-term borrowing plans. Nonetheless, the government has clearly reaffirmed its commitment to Bitcoin’s future, solidifying its position as one of the most aggressive state-level crypto investors worldwide.

Japan Implements Landmark Cryptocurrency Tax Reform: From 55% to a Flat 20%

The Japanese government has initiated comprehensive reforms to cryptocurrency taxation, addressing a long-awaited industry demand. Under the draft legislation, taxation on Bitcoin, Ethereum, and 105 other digital assets will be restructured, reducing the highest income tax rate of 55% to a flat 20% capital gains tax.

This aligns crypto gains with stocks and other financial instruments, and experts note that it will remove both fiscal uncertainty and the heavy tax burden for Japanese crypto investors, significantly easing market conditions.

The reform goes beyond tax cuts. By classifying crypto assets as financial products, issuers will be required to provide publicly accessible, auditable information on project structure, team composition, and potential risks. Another key measure extends insider trading regulations to crypto markets, preventing unfair gains through private information.

If enacted, investors can offset losses for up to three years against future gains, creating a fairer, more sustainable tax system. The legislation is expected to be presented to parliament and come into effect during the 2026 fiscal year. This step positions Japan to move away from one of Asia’s strictest crypto tax regimes toward becoming a highly competitive and investor-friendly crypto hub.

Tether Expands into Bitcoin-Collateralized Lending with Strategic Ledn Investment

Tether is making a strong entry into the consumer Bitcoin-collateralized lending market through a strategic investment in the leading platform Ledn. This move reflects Tether’s intent not only to issue stablecoins but also to expand its role as a provider of financial infrastructure.

Ledn’s model allows users to obtain credit without selling their digital assets. The platform provides custody, risk management, and liquidation services, enabling both retail and institutional clients to leverage Bitcoin as collateral.

Ledn’s collateralized lending volume grew rapidly in 2025, with annual recurring revenue exceeding hundreds of millions of dollars, highlighting the increasing demand for Bitcoin-backed credit. Tether CEO emphasized that the investment aligns with a broader vision to integrate digital assets into a more inclusive financial system.

This strategic partnership aligns with Tether’s long-term goals: creating products that protect users’ assets while generating utility, reflecting a vision of cryptocurrencies as financial instruments rather than mere investments.

Metaplanet Deepens Bitcoin Treasury Model with New Capital Initiative

Japanese firm Metaplanet announced a new capital structure to expand its Bitcoin-based treasury strategy. The company plans a two-tier structure of preferred shares aimed at overseas investors, designed to increase treasury assets while limiting dilution for existing shareholders.

The Class A (MARS) and Class B (MERCURY) preferred shares form the backbone of Metaplanet’s Bitcoin accumulation strategy. MARS shares offer adjustable dividends at a higher tier, while MERCURY shares provide perpetual, continuous returns. This structure allows the company to raise new funds while continuing to purchase Bitcoin.

The capital raise aims to collect approximately $150 million, significantly increasing the Bitcoin treasury. This initiative is part of Metaplanet’s “Bitcoin Flywheel 2.0” vision: accumulating Bitcoin even in volatile markets while maintaining sustainable returns for shareholders. The move not only strengthens Metaplanet’s balance sheet but also introduces a new model in the competitive landscape of corporate Bitcoin treasury management.

Vitalik Buterin Issues Ethereum Warning: Institutional Funds Could Undermine Network Fundamentals

Ethereum co-founder Vitalik Buterin has warned that recent influxes of institutional investment pose significant risks to the network’s decentralization and community dynamics. Large-scale institutional participation may erode the blockchain’s core values.

Institutional influence on technical decision-making, such as demands to accelerate block times, could marginalize ordinary users and community developers. Buterin also highlighted risks to Ethereum’s geographical and ideological diversity. A reduction in decentralization could transform the network into a “corporate financial tool,” conflicting with Ethereum’s long-term mission.

His statements have sparked a critical debate within the Ethereum ecosystem: how to balance growth and institutional adoption with a decentralized, community-driven structure. This warning calls on investors and developers to reassess strategic priorities for Ethereum’s future.

Michael Selig’s CFTC Chair Nomination Moves to Senate Vote

In the U.S., Michael Selig’s nomination as CFTC chair has advanced past the Senate Agriculture Committee to the full Senate, clearing a key hurdle. The committee’s Republican members announced their support, while no Democrats voted in favor. This indicates that the final Senate vote may involve intense political negotiation.

Selig’s nomination comes at a critical juncture for the CFTC’s role in digital asset markets. While his expertise and experience in crypto have drawn both support and criticism, he emphasized the strategic importance of digital assets for the commission and the need for a clearer, actionable regulatory framework. Critics point to potential conflicts of interest due to his past industry ties, stressing the need for the CFTC to maintain balanced oversight in traditional commodity markets.

The Senate vote outcome will be closely watched, given its implications for crypto regulation and broader financial policy.

Solana ETFs Continue Strong Inflows

Newly launched Solana (SOL) spot ETFs have continued to attract investor interest, even as market weakness exerts downward price pressure. Despite recent volatility, SOL ETFs recorded net inflows of $476 million since launch, maintaining positive inflows for 17 consecutive days.

ETF inflows provide a stabilizing factor amid market turbulence, although macroeconomic conditions and overall crypto risk appetite remain key determinants. The steady demand signals ongoing investor confidence, both retail and institutional, in Solana.

Spot Bitcoin ETFs End Five-Day Outflow Streak

On November 19, spot Bitcoin (BTC) ETFs recorded net inflows of $75.47 million, reversing a five-day outflow streak and signaling renewed institutional demand. Analysts interpret the inflows as evidence that risk-averse investors are beginning to reenter the spot Bitcoin market indirectly.

These inflows not only support prices but also reflect long-term institutional confidence in Bitcoin. While short-term volatility persists, the capital flowing into spot ETFs boosts market sentiment and may alleviate selling pressure, confirming that Bitcoin ETFs continue to serve as a safe haven for institutional investors.

Overall Assessment

This month, the crypto and digital finance ecosystem drew attention with significant progress in both regulatory developments and institutional adoption. Hong Kong’s initiation of tokenized deposits and real-value transaction tests with digital assets marked a critical milestone in the global financial sector’s transition to blockchain-based infrastructure. Tether’s strategic investment in Ledn and the potential billion-dollar entry into Neura Robotics demonstrated the company’s robust expansion strategy across crypto lending as well as AI–robotics sectors.

On a national level, El Salvador’s historic single-day Bitcoin purchase underscored its ambitious reserve policy, while Japan’s decision to reduce crypto taxes from 55% to 20% aimed to make the sector more competitive. On the institutional side, Metaplanet’s expansion of its Bitcoin-centric treasury model and Vitalik Buterin’s warnings regarding large funds’ impact on Ethereum sparked important discussions. In the U.S., the CFTC chair nomination moving to the Senate highlighted regulatory activity, while record consecutive inflows into Solana ETFs and the halting of the Bitcoin ETF outflow trend indicated strengthening institutional demand.

Altogether, these developments point to a powerful transformation period in crypto markets, where technological innovation, regulation, and investment dynamics are accelerating simultaneously.

Related Articles

Spot Crypto ETFs: Global Rise and Turkey’s Roadmap

Pakistan’dan Ulusal Bitcoin Rezervi Hamlesi