10 Years of Ethereum: A Detailed Review from Inception to Today

10 Years of Ethereum: A Detailed Review from Inception to TodayIn this article, we cover all aspects of Ethereum’s 10-year journey from its inception to the DAO crisis, from the Merge transition to its cultural impact, from its technical evolution to its 2030 vision.

Ethereum is an innovative blockchain platform born on July 30, 2015 with the mining of its first block (the genesis block). Over the past 10 years, Ethereum has revolutionized finance and internet applications by transforming the vision of a programmable “world computer” from a mere cryptocurrency network to a reality through smart contracts. Ether (ETH) is the second largest cryptocurrency by market capitalization after Bitcoin. Today, the Ethereum network is the foundation for brand new industries such as decentralized finance (DeFi) and NFT .

Establishment and Launch (2013-2015)

The Ethereum project was launched in 2013 with a whitepaper published by a 19-year-old Vitalik Buterin. Buterin proposed adapting Bitcoin’s blockchain technology to broader applications beyond money transfer. Although several co-founders were initially involved, Buterin took the lead in mid-2014 when the project was transformed into a non-profit foundation. The development cost was covered by an online initial public offering (ICO) in July-August 2014, raising around US$18 million by selling Ether for Bitcoin. About a year later, on July 30, 2015, the Ethereum network went live with its first version, code named “Frontier”. Frontier used the Proof-of-Work consensus mechanism from Bitcoin and included the Ethereum Virtual Machine (EVM) infrastructure that runs smart contracts. This made it possible to automatically and reliably transfer any digital value through programs running on the blockchain. Ethereum’s code also included a “difficulty bomb” delay mechanism that would force a future transition to Proof-of-Stake (PoS), meaning that in the long run, PoW mining would become more difficult, encouraging the transition to the new PoS chain.

Early Challenges: The DAO Crisis (2016)

The first major test Ethereum faced was “The DAO” crisis in 2016. The DAO, a decentralized investment fund founded by a group of Ethereum developers, raised a record amount of funds - around $150 million - in a public sale in April 2016. However, in June 2016, attackers exploited a vulnerability in DAO’s smart contract and stole $50 million worth of Ether. This event amounted to a massive loss of 15 %15% of the entire amount of Ether in circulation at the time. The community discussed either accepting the loss without interfering with the blockchain, or recovering the stolen funds through a hard fork of the chain. In the end, the majority chose the second option and the effects of the attack were reversed with a hard fork in July 2016. Although this move saved the Ethereum network, the chain split in two: The network that implemented the intervention continued as Ethereum, while those who did not participate in the change continued the original chain under the name “Ethereum Classic”. The DAO crisis has gone down in Ethereum history as a turning point where the balance between the principle of code immutability and community interests was tested.

Ecosystem Growth: ICO Mania and Scalability Issues (2017-2018)

The year 2017 was characterized by the “Initial Coin Offering” (ICO) on Ethereum. Thanks to the convenience of the ERC-20 token standard, hundreds of projects crowdfunded by issuing their own tokens on the Ethereum network; billions of dollars were raised through this method during 2017-2018. While the ICO boom has boosted the use of Ethereum to unprecedented levels, the abundance of malicious and failed projects has also brought regulatory scrutiny. At the same time, increasing demand strained the network’s capacity. The CryptoKitties game, which became particularly popular in late 2017, highlighted Ethereum’s scalability problem by clogging the network with heavy transaction volume and causing fees to skyrocket. In response to these problems, developers started working on second-layer scaling solutions such as Plasma and state channels. Significant improvements were made to the protocol with updates to Byzantium in October 2017 and Constantinople in February 2019.

DeFi Revolution and NFT Mania (2019-2021)

With the end of the ICO era, Ethereum has seen the rise of decentralized finance (DeFi) applications. During the “DeFi Summer” of 2020, the amount of assets flowing into DeFi protocols via liquidity mining (yield farming) methods skyrocketed, and by mid-2021, the total value locked in DeFi applications on Ethereum exceeded $100 billion. With the success of the DeFi ecosystem, Ethereum has become a decentralized banking system, while the increased transaction density has led to higher fees on the network.

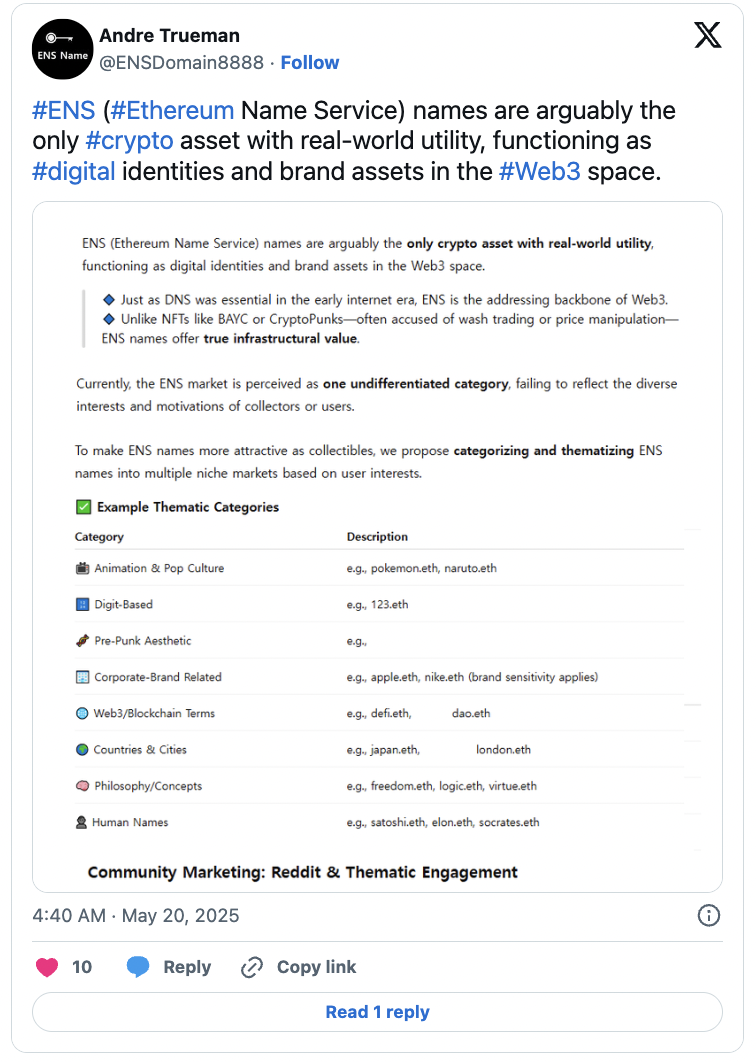

In 2021, the NFT hype went global, with digital art and collectibles on Ethereum fetching millions of dollars. In March 2021, an NFT collage was sold for $69 million, marking the peak of this field. While Ethereum-based collectibles like CryptoPunks and Bored Ape Yacht Club gained immense popularity, network congestion occurred during moments of peak demand, with gas fees running into the hundreds of dollars.

Source: https://x.com/ENSDomain8888/status/1924641377037713769

Launched to celebrate Ethereum’s 10th anniversary, the “Ethereum Torch” initiative is a meaningful NFT project that symbolizes the decentralized nature and global solidarity of the community. This symbolic torch was transferred to a different community member’s wallet every day for 10 days, representing collective memory. At the end of the tour, the torch was permanently lit on behalf of the Ethereum community.

Source: https://x.com/pangolindex/status/1947364720140275797

To commemorate this moment, the Ethereum Foundation announced that it will release a commemorative NFT that anyone can own for free. This period was not only culturally but also technically buoyant, with a 300% increase in on-chain NFT sales and a 50% jump in ETH demand.

An EIP-1559 update was implemented in August 2021 with a hard fork codenamed London to address the issue of increased fees. This change alleviated the problem of excessively high fees and increased the predictability of fees by ensuring that the base fee was burned in every transaction. Around the same time, “rollup” second layer networks such as Arbitrum and Optimism were launched, allowing users to take advantage of Ethereum’s security and transact at much lower costs.

The Merge: Moving from Proof of Work to Proof of Stake (2022)

The biggest protocol change in Ethereum history came with “The Merge” update in September 2022. With this step, Ethereum has seamlessly transitioned from the energy-intensive Proof of Work (PoW) consensus it has been using since its inception to a Proof of Stake (PoS) system. In preparation, the PoS-based Beacon Chain network was launched in December 2020 and ran in parallel with the PoW chain for nearly two years. In September 2022, these two chains were merged and Ethereum block production was completely transferred from miners to validators. As a result, Ethereum’s energy consumption %has decreased by more than 99% and its environmental impact has been reduced to negligible levels. Moreover, this radical transformation was successfully completed without disruption to the network.

Current Situation in Ethereum’s 10th Anniversary (2023-2025)

At this point, the Ethereum network is a much more mature and scalable ecosystem than in the early years. With the Shanghai/Capella update in 2023, the withdrawal of staked ETH was enabled and the PoS transition was completed. Currently, close to 870,000 validators and more than 13,000 nodes secure Ethereum worldwide.

The current asset and transaction sizes on Ethereum are also remarkable. By 2025, the total value of stablecoins circulating on the mainnet is $123 billion, more than half of the worldwide stablecoin supply. Again, the total value locked in Ethereum-based DeFi protocols is approximately $75 billion. With the proliferation of second-layer rollup technologies, Ethereum’s transaction capacity has also increased; in total, the ecosystem can process over 250 transactions per second.

Ethereum adoption is also continuing in traditional finance and government. Major financial institutions are developing asset tokenization and payment infrastructures on Ethereum, while some central banks are working on digital currency projects based on the Ethereum model. All these indicators show that Ethereum is now becoming a critical infrastructure not only in the crypto world, but also in the general economy and technology.

Ethereum Towards 2030

Ethereum has a comprehensive development roadmap for the coming years. The Surge, The Scourge, The Verge, The Verge, The Purge, and The Splurge, as announced by Vitalik Buterin, aim for major improvements in areas such as scalability, censorship resistance, and protocol simplification. For example, the EIP-4844 (proto-danksharding) update, expected in 2024, aims to further reduce transaction fees by reducing the data cost of the rollup layer.

In the long term, Ethereum envisions moving to a modular architecture where the main chain provides security and transactions are executed in secondary layers. This will greatly overcome the scalability problem and increase network efficiency.

Of course, the Ethereum ecosystem faces challenges such as improving the user experience, privacy and addressing regulatory uncertainties. But the innovative breakthroughs of the first decade give the community confidence that these challenges can be overcome. In conclusion, the story of Ethereum, born as an idea and evolved over a decade into a global value transfer and application platform, is far from over. As the Ethereum Foundation emphasizes, Ethereum’s journey is actually “just beginning.”

Related Articles

Spot Crypto ETFs: Global Rise and Turkey’s Roadmap

The 10 Biggest Crypto Hacks in History