Weekly Summary: A New Era in Global Crypto and Digital Finance Markets

Explore the latest developments in the cryptocurrency market, spotlighted projects, and potential investment opportunities, all consolidated in a single weekly bulletin. Gain insights through market analyses, significant announcements, and sector-wide summaries that capture the pulse of the crypto world.

Period: 22.12.2025 – 26.12.2025

Summary

In the recent period, crypto and global financial markets have reflected a landscape shaped by rising uncertainty alongside structural transformation. In the United States, spot Bitcoin ETFs recorded net weekly outflows of $497 million, with particularly heavy redemptions from BlackRock’s IBIT fund reinforcing signs of short-term risk aversion among institutional investors. Meanwhile, the Bank of Japan’s decision to end its negative interest rate policy maintained since 1995 by implementing a rate hike sent a strong signal that global liquidity conditions may begin to tighten. Ripple CTO David Schwartz challenged price-centric narratives in crypto markets, emphasizing that XRP demonstrates real adoption through more than 4 billion fast, low-cost settlement transactions rather than price performance alone. In parallel, the U.S. crypto sector’s $8.6 billion in mergers and acquisitions throughout 2025 highlighted its progression toward greater institutional maturity, while Strategy’s CEO maintaining long-term optimism despite Bitcoin’s sharp decline underscored continued corporate conviction in the asset. In Asia, HashKey Capital’s $250 million fundraise strengthened regional confidence in crypto investments, even as the transfer of $292 million worth of Ether by the so-called “10/10 whale” reignited concerns over potential market volatility. Adding a geopolitical dimension, Bitcoin’s indirect mention during nuclear energy discussions between Russia and the United States illustrated how digital assets are increasingly intersecting not only with finance, but also with global strategic and diplomatic debates.

Sharp Outflows Hit Spot Bitcoin ETFs

U.S.-listed spot Bitcoin ETFs showed a clear slowdown in investor appetite over the past week, signaling a pause in market momentum. Weekly net outflows totaled $497 million, indicating a weakening of risk-taking sentiment in the short term. The more cautious stance adopted by institutional investors was clearly reflected in the scale of capital exiting these funds.

At the center of the outflows was one of the market’s largest spot Bitcoin ETFs. BlackRock’s IBIT fund recorded approximately $240 million in net outflows, making it the most notable data point of the week. This figure accounted for nearly half of total outflows, offering a strong signal of shifting sentiment within the ETF market.

Market experts note that this development should not be viewed as crypto-specific alone. Volatility in Bitcoin prices, uncertainty surrounding U.S. Federal Reserve monetary policy, and ongoing global macroeconomic pressures are directly influencing investor behavior. In particular, rising bond yields and a stronger U.S. dollar have emerged as key factors limiting demand for highly volatile assets.

That said, analysts emphasize that these ETF outflows are not necessarily decisive for the long-term outlook. By nature, spot ETFs are highly sensitive to short-term capital movements. Previous episodes have shown that similarly sized outflows were often followed by strong inflows, underscoring the importance of broader trend analysis.

Looking ahead, attention will turn to upcoming U.S. inflation data and statements from Federal Reserve officials. These factors are expected to play a critical role in determining whether institutional investors regain their appetite for risk and whether demand for spot Bitcoin ETFs rebounds. For now, the overall picture suggests that the market has entered a cautious wait-and-see phase.

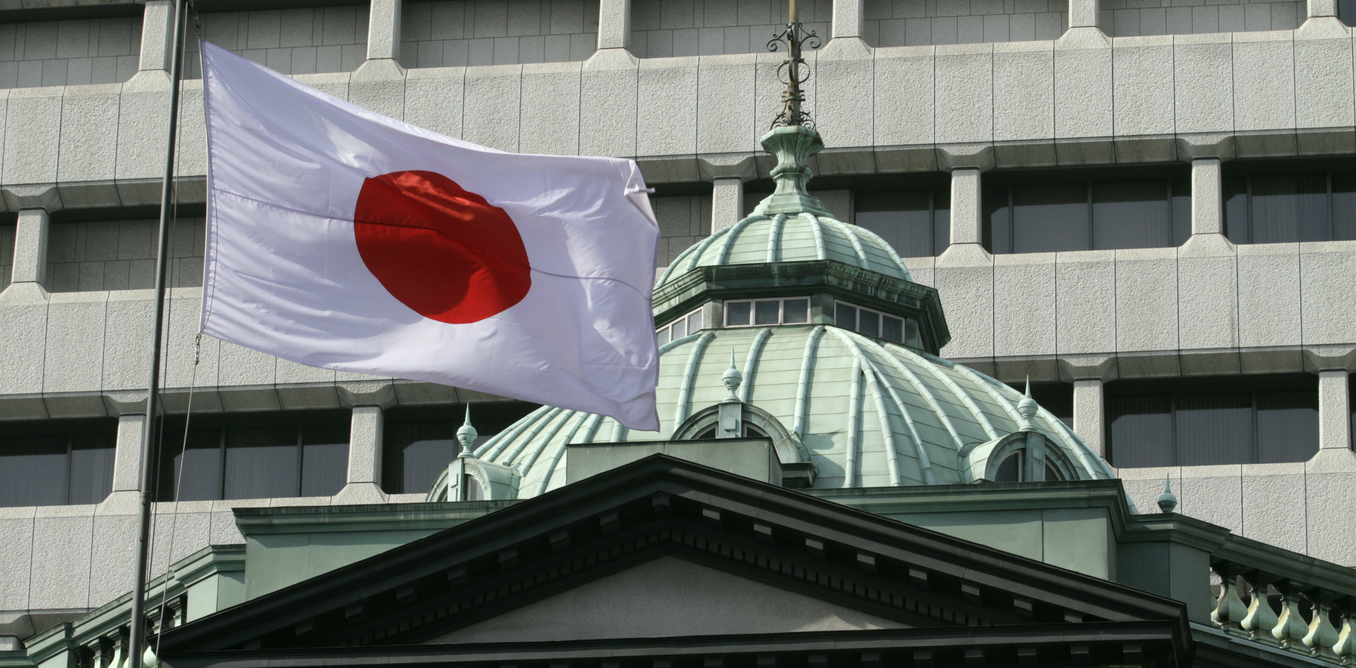

Historic Move from the Bank of Japan

The Bank of Japan (BoJ) has taken a critical step that has resonated widely across global markets. At its monetary policy meeting on December 19, 2025, the BoJ raised its short-term policy rate by 25 basis points to 0.75%. This decision marks a definitive break from the negative interest rate policy Japan has maintained since 1995.

The move is being viewed as a historic turning point not only for the Japanese economy but also for the global financial system. After years of battling low inflation and weak domestic demand, Japan has officially brought its ultra-loose monetary policy era to an end. In its statement, the BoJ emphasized that inflation has become more sustainable and that wage growth is now supporting broader economic recovery.

Central bank officials were careful to stress that this rate hike does not signal an abrupt tightening cycle. The BoJ noted that monetary policy remains accommodative, but economic conditions no longer justify negative interest rates. Factors such as energy prices, global trade dynamics, and a rebound in domestic consumption were cited as key drivers behind the decision.

Market reactions were first felt in the Japanese yen, which strengthened against major currencies following the announcement, while Japanese government bond yields moved higher. This shift has prompted renewed scrutiny of long-standing “carry trade” strategies that relied on borrowing in low-yielding yen to invest in higher-yielding assets elsewhere. Experts suggest that Japan’s rate increase could have broader implications for global capital flows.

From the perspective of crypto and other risk assets, the BoJ’s move is seen as a signal that global liquidity conditions may gradually tighten. Given Japan’s long-standing role as an indirect provider of liquidity to global markets, the implications of this policy shift are particularly significant.

Analysts expect the BoJ to proceed with extreme caution in its next steps, with any further rate increases likely to be gradual and data-dependent. Regardless of the path ahead, Japan’s official exit from the negative interest rate era is set to remain a landmark moment in the history of global monetary policy.

Ripple CTO David Schwartz Highlights XRP’s Real-World Adoption

Ripple CTO David Schwartz criticized judging XRP solely by its market price, arguing that true success should be measured by real usage and adoption on the network. In a statement shared on social media, Schwartz emphasized that the XRP Ledger has processed more than 4 billion fast, low-cost settlement transactions to date, describing this as a rare example of tangible, real-world utility in the crypto industry.

According to Schwartz, a large portion of crypto assets are still primarily priced based on speculative expectations. XRP, however, stands apart from this general trend. The Ripple CTO noted that price movements are largely shaped by short-term market psychology, whereas the technological capabilities of a network and its level of usage represent far more durable indicators of value. He added that, particularly in cross-border payments and financial infrastructure solutions, the performance of the XRP Ledger surpasses that of many competing blockchains.

One of the most important points highlighted by David Schwartz was XRP’s transaction efficiency. Transactions on the XRP Ledger are completed within seconds and at extremely low costs, making the network especially attractive for institutional use. Schwartz argued that these advantages are not merely theoretical but are actively utilized by banks, payment providers, and financial institutions in real-world applications. In his view, the fact that the network has processed more than 4 billion transactions serves as concrete evidence against claims that XRP lacks adoption.

Schwartz also cautioned against the common “price equals success” narrative in the crypto market. He pointed out that many projects achieve high prices despite offering limited real-world utility, whereas XRP operates as a functional and value-generating infrastructure regardless of price fluctuations. This perspective aligns closely with Ripple’s long-standing vision of building blockchain solutions that address real-world problems rather than relying solely on speculative appeal.

Record Mergers and Acquisitions in the U.S. Crypto Sector in 2025

The U.S. crypto sector experienced one of its most active periods of mergers and acquisitions (M&A) in 2025. Throughout the year, a total of 267 M&A deals were completed, with the combined value of these transactions reaching $8.6 billion. These figures are widely interpreted as a clear sign that crypto markets are rapidly moving toward greater institutional maturity.

According to experts, several key factors are driving this surge in deal activity. Most notably, clearer regulatory frameworks in the United States have given large corporations and investment funds more confidence to enter the crypto space. Reduced regulatory uncertainty has made companies operating in areas such as infrastructure, custody services, blockchain software, and data analytics particularly attractive acquisition targets.

A significant portion of these mergers and acquisitions took place between institutional service providers and blockchain infrastructure firms. Rather than building crypto operations from scratch, major financial institutions and technology companies opted to acquire established teams and proven technologies. This approach not only saved time but also helped simplify regulatory compliance and market entry.

Analysts emphasize that the $8.6 billion total deal value represents more than just financial scale; it also marks a symbolic milestone in the integration of crypto into mainstream finance. The growing involvement of banks, asset management firms, and payment giants underscores the fact that crypto is no longer a niche market but an increasingly integral part of the broader financial ecosystem.

However, the consolidation trend has also raised concerns. Advocates of decentralization argue that increasing control by large players could reduce competition and undermine some of the core principles of the crypto industry. On the other hand, proponents of institutional involvement believe that consolidation will bring greater stability, trust, and long-term sustainable growth to the sector.

Overall, the 2025 data clearly shows that the U.S. crypto industry has moved beyond its early experimental phase and has evolved into an institutionally scaled sector. Experts expect this trend to continue in the coming years, with even larger and more strategic acquisitions likely to shape the future of the market.

Strategy CEO Holds Firm

Strategy (MSTR), known for its digital asset treasury model, continues to maintain its strategic stance despite the sharp pullback in Bitcoin’s price. After Bitcoin fell below the $87,000 level, the company experienced significant valuation losses on its balance sheet, drawing attention to statements made by Strategy’s CEO. He emphasized that short-term price movements do not alter the company’s long-term Bitcoin vision.

In recent years, Strategy has stood out as one of the most aggressive corporate players positioning Bitcoin as its primary reserve asset. The company has carried out regular BTC purchases through methods such as debt issuance and capital raises, a strategy that has attracted both strong support and sharp criticism. With Bitcoin retreating from its peak levels, Strategy is estimated to be facing billions of dollars in unrealized losses on paper.

In his remarks, the CEO described Bitcoin’s short-term volatility as “expected and manageable” from the company’s perspective, stressing that the core focus remains on Bitcoin’s long-term role as a store of value and its narrative of digital scarcity. He also reiterated the view that Bitcoin continues to represent a strategic asset in the face of global monetary policies, inflationary pressures, and broader uncertainties within the financial system.

Market analysts note that Strategy’s unwavering approach could contribute to continued volatility in the company’s stock price. However, they also highlight that this stance serves as a strong signal of institutional conviction within the crypto ecosystem. At a time when interest in Bitcoin via ETFs and institutional funds is growing, Strategy’s position carries symbolic significance for the broader market.

$292 Million Ether Transfer Raises Market Concerns

A mysterious investor known in the crypto market as the “10/10 whale”who reportedly earned nearly $200 million by opening short positions just before the sharp market crash on October 10 has resurfaced. On-chain data reveals that the whale has transferred $292 million worth of Ether (ETH) to the Binance exchange.

The large-scale transfer immediately sparked concerns about a potential sell-off, creating uncertainty among market participants. The move is particularly notable as it comes at a time when Ether is trading near key technical support levels, raising speculation that the whale may be preparing for a new market position.

While analysts caution that not every large exchange transfer necessarily signals an imminent sale, this specific wallet is being closely monitored due to its historically precise market timing. Previous actions by the “10/10 whale” have shown a strong correlation with periods of heightened downside volatility.

On-chain analysts also emphasize that the whale’s activity should be assessed not only through spot price movements, but also in terms of derivatives market positioning, open interest, and funding rates. Expectations of increased volatility in the Ether market have strengthened in the days ahead.

Russia and the U.S. Reopen Nuclear Talks Bitcoin Draws Attention

Energy diplomacy between Russia and the United States, which had remained largely frozen for an extended period, has recently regained momentum through discussions centered on nuclear power plants. What captured international attention, however, was the unexpected emergence of Bitcoin as a peripheral topic in these talks. While the discussions primarily focused on nuclear energy cooperation, technology sharing, and financing models, the indirect mention of digital assets highlighted the growing intersection of energy, geopolitics, and crypto.

The core agenda includes next-generation nuclear plant projects, modernization of existing facilities, and securing nuclear fuel supply chains. Russia remains a major global player thanks to its extensive nuclear expertise and construction capabilities, while the U.S. closely monitors such engagements to safeguard energy security and strategic influence. This time, however, the talks extended beyond purely technical and diplomatic boundaries.

New Approaches to Financing and Payment Models

Western sanctions on Russia have increasingly complicated the financing of large-scale energy projects, prompting a search for alternative financial mechanisms. In this context, Bitcoin and other digital assets while not positioned as direct payment tools have been discussed as potential instruments for cross-border value transfer, balance sheet diversification, and financial flexibility.

According to diplomatic sources, Bitcoin is not a central element of nuclear agreements. However, its mere inclusion among examples of alternative financial systems amid discussions on sanctions risk and financial fragility is viewed as a meaningful signal. This underscores how crypto assets are evolving beyond investment vehicles into indirect components of geopolitical discourse.

Energy, Bitcoin, and Geopolitics

Bitcoin’s high energy consumption has long been controversial, making its association with nuclear energy particularly striking. On one side stands nuclear power low-carbon and capable of providing uninterrupted energy; on the other, Bitcoin mining, known for its intensive energy requirements. In recent years, the idea of using excess or nuclear-generated energy for digital asset mining has gained traction in several countries.

Russia’s vast energy reserves and nuclear infrastructure theoretically provide fertile ground for such models. In contrast, the U.S. continues to approach Bitcoin more cautiously, particularly through the lenses of national security, energy policy, and financial stability. Bitcoin’s indirect presence at the negotiation table highlights these differing strategic perspectives.

Crypto Assets Enter the Diplomatic Arena

Experts suggest that these developments illustrate how crypto assets are increasingly becoming reference points in global diplomacy. Even without playing a direct contractual role, Bitcoin’s relevance in discussions on sanctions, payment systems, and energy security signals that digital assets can no longer be ignored.

As financing models evolve in strategic sectors like energy, and as alternative systems gain visibility, cryptocurrencies may assume a more prominent role in state-level economic and geopolitical strategies over the long term.

Related Articles

Spot Crypto ETFs: Global Rise and Turkey’s Roadmap

The 10 Biggest Crypto Hacks in History