December 2025 Crypto Summary: Critical Turning Points Shaping the Market

The crypto markets have gone through an intense period where regulations and institutional moves stood out. Actions by stablecoin players such as Tether and Circle accelerated institutional adoption, while regulations from the US, the UK, and other countries strengthened crypto’s integration into traditional finance. In the short term, ETF outflows and whale movements showed weaker risk appetite, but corporate Bitcoin purchases and tokenization developments revealed that crypto is becoming a lasting financial infrastructure in the long term.

Price Changes of Major Cryptocurrencies in December

December 2025 Crypto Agenda: Key Developments

Large Weekly Outflow from Spot Bitcoin ETFs

In the first week of December, a total net outflow of $497 million was recorded from spot Bitcoin ETFs traded in the US. The outflow of approximately $240 million from BlackRock’s IBIT fund was particularly significant, indicating institutional investors’ short-term risk aversion.

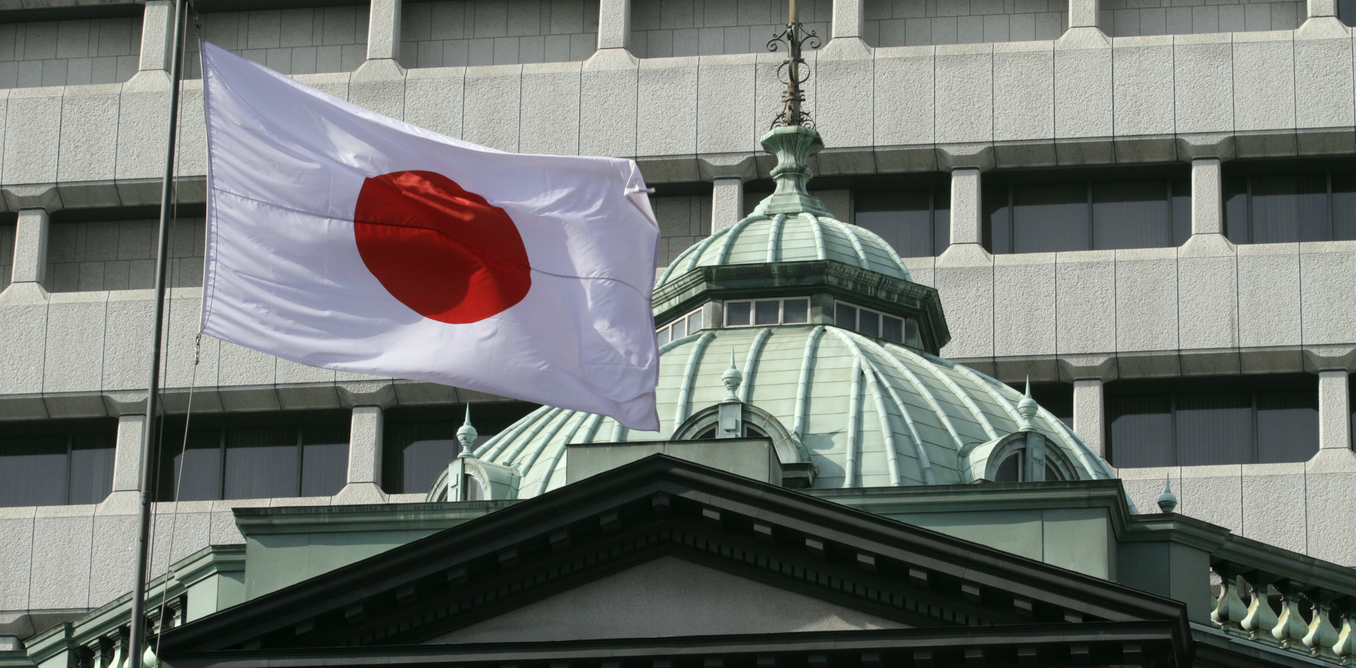

Bank of Japan Makes Historic Interest Rate Hike

The Bank of Japan (BoJ) ended its nearly 30-year negative interest rate policy, raising the policy rate to 0.75%. This decision affected the perception of global liquidity and altered pricing behavior in risky asset markets.

XRP Usage Data Comes to the Fore

Ripple CTO David Schwartz emphasized that XRP should be evaluated based on its actual usage rather than its price. The fact that the XRP Ledger has processed over 4 billion low-cost, fast transactions strengthens the project’s adoption argument. Record M&A in the US Crypto Sector. Throughout 2025, 267 crypto mergers and acquisitions took place in the US, totaling over $8.6 billion. This was one of the most concrete indicators that the sector is progressing towards institutional maturity.

Strategy (MSTR) Maintains its BTC Stance

Despite the significant downward trend in Bitcoin price, Strategy CEO announced that the company will not change its long-term Bitcoin investment strategy. This message was symbolic in terms of institutional players’ confidence in the market.

Major Investment in Crypto Fund from Asia

Singapore-based HashKey Capital announced that it has received $250 million in investment for its new crypto fund and plans to raise its target to $500 million. The regulation-friendly environment in Hong Kong also contributed to this increased interest. $292 Million Transfer from an Ether Whale. A large investor, known in the market as a “10/10 whale,” transferred $292 million worth of Ether to Binance. This move has sparked speculation among investors about potential selling pressure.

Tether’s Massive Share Sale Move: Seeking $20 Billion in Liquidity

Tether Holdings SA, the issuer of USDT, the world’s largest stablecoin, is working on a share sale plan that could significantly impact the balance in global crypto markets. The company is reportedly considering a limited share sale to raise up to $20 billion in capital. The primary goal of this move is to create new liquidity options to meet increasing investor interest and support Tether’s long-term growth strategy.

The planned share sale is seen as part of Tether’s goal to move beyond being just a stablecoin issuer and build a broader financial and technological ecosystem. In recent years, the company has diversified its operations by investing in various fields such as energy, artificial intelligence, data infrastructure, and media. The new capital raised is expected to be used to finance Tether’s new business lines and increase its global influence, rather than strengthening its stablecoin reserve structure. On the other hand, Tether management is evaluating more innovative financial models in addition to traditional share sales to meet investors’ liquidity expectations. It is rumored that the company is working on tokenized share-like structures or alternative investment instruments. Such an approach could allow investors familiar with the crypto ecosystem easier access to Tether indirectly. If this plan is implemented, Tether could become one of the most highly valued private companies not only in the stablecoin market but also in global capital markets. This development shows that the stablecoin market is increasingly evolving into a more institutional structure, and large players are beginning to associate more closely with classical financial methods. Tether’s actions could pave the way for similar capital models for other large crypto companies in the future.

UK Sets Clear Framework for Crypto: Full Regulation by 2027

The UK is preparing a comprehensive regulation aimed at bringing the crypto asset sector to the same legal footing as the traditional financial system. Under the planned legislation, crypto companies will be fully under the supervision of the Financial Conduct Authority (FCA) by October 2027. This regulation will bring digital assets closer to traditional financial products in terms of legal status.

The new framework is designed to cover crypto exchanges, custody companies, and other digital asset service providers. The aim is to eliminate the uncertainty that has long been criticized in the sector, protect investors, and increase market security. British authorities emphasize that a stricter regulatory mechanism has become inevitable following bankruptcies, fraud cases, and user losses in the crypto market.

Once the regulation is implemented, crypto companies will be subject to certain capital adequacy, transparency, customer asset protection, and risk management standards, just like banks and investment firms. While this may increase costs for companies operating in the sector, it could contribute to a more reliable and sustainable market structure in the long run.

US Senate Postpones Crypto Market Structure Act to 2026

The US Senate Banking Committee canceled a hearing scheduled for this year to address the critical “market structure” law, which was expected to define the framework of the cryptocurrency market. Following the decision, it became clear that the regulatory process has been postponed to 2026. This development indicates that uncertainty regarding crypto regulations in the US will continue for at least another year.

The market structure law aimed to clarify which regulatory body has jurisdiction over crypto assets. In particular, resolving the jurisdictional confusion between the US Securities and Exchange Commission (SEC) and the Commodity Futures Commission (CFTC) was one of the key issues that the sector has long demanded. However, with the cancellation of the hearing, it is understood that this clarification will not happen in the short term.

Sector representatives argue that the postponement creates a serious planning challenge for crypto companies in terms of investment, growth, and US-based operations. It is particularly noted that institutional investors are acting more cautiously in a market with an unclear regulatory framework. This situation is being interpreted as potentially causing the US to fall behind regions like Europe, Asia, and the Middle East in global crypto competition. Messages from the committee indicate that the political calendar, the election process, and the re-prioritization of regulatory priorities have been influential in this postponement. However, it is stated that the draft law has not been completely shelved, and that it is aimed to be brought back to the agenda in 2026 with a more comprehensive and consensual text. Despite this, the market has largely suspended expectations of rapid progress on the regulatory side in the short term.

Crypto Executives Call on SEC for Privacy

Leading executives and blockchain developers in the crypto sector have issued a joint call to the US Securities and Exchange Commission (SEC), emphasizing that blockchain privacy tools should not be associated solely with illegal activities. The statements specifically noted that privacy technologies have legitimate use cases such as financial freedom, data security, and the protection of trade secrets.

Industry representatives argue that the increasing regulatory pressure on privacy-focused protocols and tools in recent times negatively impacts innovation. Privacy solutions are said to prevent individuals’ entire financial transactions from being traceable by everyone, thus functioning similarly to customer privacy in the traditional banking system. According to crypto executives, privacy should not be automatically equated with crime, but rather treated as a natural component of the modern digital economy. The SEC’s approach to date is frequently criticized for being more focused on enforcement and restriction. The crypto side argues that instead of completely banning privacy technologies, the regulator should develop a risk-based and targeted oversight model. Such an approach would both enable the fight against money laundering and financial crimes and prevent innovative projects from moving outside the US. This call, considered alongside the delay in legislation in the US Senate, indicates that the regulatory tension between the crypto sector and Washington will continue. Sector actors argue that the absence of clear and balanced rules deepens uncertainty and could harm the US’s technological leadership. How the SEC responds to these calls in the coming period will be decisive for both the future of privacy technologies and the US’s position in the crypto ecosystem.

Bank of Canada Sets Tight Framework for Stablecoins

The Bank of Canada has clarified its approach to future issuance of stablecoins in the country, sending a significant policy signal for the digital asset market. The bank’s assessment emphasizes that Canada-based stablecoins must be backed by high-quality and liquid assets, and that pegging these digital currencies to the Canadian dollar at a one-to-one ratio is critical. This approach aims to increase the reliability of stablecoins as a means of payment and a store of value.

According to the central bank, stablecoins not backed by sufficient and transparent reserves can pose risks to financial stability. Reserve quality is vital to prevent scenarios such as sudden redemption demands, periods of market stress, and erosion of user confidence. Therefore, the view that they should be based on readily convertible, low-risk, and highly liquid assets is highlighted.

Furthermore, the one-to-one pegging requirement aims to limit the indirect impact of stablecoins on Canadian monetary policy. The Central Bank is concerned that the uncontrolled growth of private digital currencies is putting pressure on traditional payment systems and banking infrastructure.

It is pointed out that this could create a situation where stablecoins are compatible with the existing financial system and are subject to oversight, rather than completely banning them. Experts state that Canada’s approach is consistent with the increasing global search for stablecoin regulation and that the country is following a cautious but open-to-innovation line in the field of digital finance. This step opens the way for the use of stablecoins in Canada while also demonstrating the adoption of a model that prioritizes investor and user trust.

SAFE Crypto Act Against Crypto Fraud in the US

US lawmakers have introduced the SAFE Crypto Act, which aims to launch a comprehensive fight against the increasing number of fraud cases in the cryptocurrency market. The bill envisages the establishment of a special task force led by the Treasury Department to combat crypto fraud, phishing attacks, and organized fraud networks. This initiative is considered one of the most comprehensive steps aimed at strengthening consumer protection in the digital asset ecosystem. The task force planned under the SAFE Crypto Act aims to increase coordination among federal agencies, detect fraud methods more quickly, and effectively combat cross-border criminal networks. It is noted that fraud, particularly through social engineering, false investment promises, and fake platforms, has reached serious proportions.

Lawmakers argue that with the growth of the crypto market, individual investors are exposed to more sophisticated attacks, and existing legal mechanisms are insufficient to address these rapidly evolving threats. The SAFE Crypto Act aims not only to increase criminal penalties but also to establish a preventative structure with early warning systems, public awareness campaigns, and technical monitoring tools.

Industry representatives approach the bill with cautious optimism. While acknowledging the undeniable need to combat fraud, they emphasize that regulations must be applied in a balanced way that does not stifle innovation. This step by the US administration is interpreted as a strong indication of its intention to move the crypto market to a safer and more regulated environment rather than completely deregulating it. When both developments are considered together, a common point stands out in both Canada’s and the US’s approach to digital assets: while supporting the growth of the crypto and stablecoin ecosystem, financial stability and user security are kept at the center. This trend indicates that the global crypto market will evolve into a more institutional and regulated structure in the coming period.

Circle Launches Strategic Partnership with LianLian Global for Global Use of USDC

Circle Internet Group, Inc., the issuer of the USDC stablecoin, has taken a significant step towards expanding its global payment infrastructure. The company announced that it has signed a Memorandum of Understanding with LianLian Global, a licensed cross-border payment provider, to explore and develop USDC use cases. This agreement aims to pave the way for more effective use of stablecoin-based payments in international trade and financial transfers.

As part of the collaboration, Circle and LianLian Global will evaluate how USDC can be positioned as a faster, lower-cost, and more transparent alternative, especially in cross-border payments. LianLian Global’s existing licensed and regulation-compliant payment infrastructure strengthens the potential of this collaboration to bridge the gap between traditional finance and the digital asset ecosystem. The aim is to increase the use of USDC not only in crypto markets but also in areas such as commercial payments, e-commerce, and corporate money transfers. For Circle, this step is seen as a significant extension of its strategy to make USDC a natural part of global payment systems. The company emphasizes that stablecoins can offer a structure that complements, rather than replaces, the banking system, and that regulation-compliant partnerships are a cornerstone of this vision. The agreement with LianLian Global creates a foundation that can strengthen the potential role of USDC, particularly in Asia-centric trade flows. For LianLian Global, this collaboration represents an opportunity to offer customers more flexible and innovative services by integrating digital assets into existing payment solutions. The instantaneous settlement and low transaction costs offered by stablecoins are seen as a solution to the delays and high fees experienced in cross-border payments. Overall, this development shows that stablecoins are beginning to play a more visible and functional role in the global financial infrastructure. This strategic collaboration between Circle and LianLian Global facilitates the adoption of USDC as a regulation-compliant digital payment instrument.

This stands out as a significant step that could accelerate its adoption and contribute to the institutional-scale growth of the stablecoin ecosystem.

Wall Street’s Infrastructure Giant DTCC Receives Tokenization Approval

Depositor Trust & Clearing Corporation (DTCC), considered one of the most critical infrastructure institutions of the US capital markets, has taken a historic step in the field of tokenization. With the approval it received from the US Securities and Exchange Commission (SEC), the institution is officially starting the process of moving traditional financial assets to blockchain infrastructure. While the tokenization of US Treasury bonds is planned in the first phase, this development is considered a significant milestone in Wall Street’s digital transformation.

DTCC’s initiative aims to make transaction, clearing, and custody processes in financial markets more efficient. Thanks to tokenization, bonds will be represented as digital tokens on the blockchain, and the transfer, reconciliation, and tracking of these assets will become much faster and more transparent. The goal is to make clearing processes, which can take days in current systems, almost instantaneous with this technology. Reducing operational costs and minimizing the risk of errors are also among the project’s core motivations.

Tokenization transactions will be carried out on the Canton Network, a closed network designed for institutional use, instead of a public blockchain. This choice is critical for regulatory compliance, data privacy, and corporate control. The Canton Network provides an infrastructure that allows different financial institutions to work together while maintaining their own systems. Thus, DTCC aims to leverage the advantages of blockchain technology while maintaining the security and auditing standards of traditional finance.

The approval from the SEC is a strong signal not only for DTCC but also for the tokenization market in general. For institutional actors who have long been cautious due to regulatory uncertainty, this development shows that digital asset-based solutions can now be integrated into the US financial system. In particular, the tokenization of assets such as US Treasury bonds, which are fundamental building blocks of global finance, will constitute an important testing ground for the scalability and reliability of this technology. According to experts, DTCC’s move could pave the way for the tokenization of stocks, funds, and other securities in the future. A move by an institution at the heart of Wall Street could open the door for similar projects by large banks, mutual funds, and market makers. This development clearly shows that blockchain technology is not limited to crypto assets but is beginning to transform fundamental processes in traditional finance. In short, the tokenization permission granted to DTCC indicates that the digitalization process in US financial markets is accelerating and that a regulatory-compliant blockchain integration is now possible. This first step, the tokenization of US bonds, is seen as a harbinger of a broader transformation in the global financial system.

Sharp Outflow from Spot Bitcoin ETFs

Spot Bitcoin ETFs traded in the US showed a significant slowdown in investor sentiment last week. A net outflow of $497 million per week indicated a weakening of risk appetite, particularly in the short term. During this process, institutional investors’ more cautious approach was clearly reflected in the amount of capital withdrawn from funds.

At the center of these outflows was one of the largest spot Bitcoin ETFs in the market. BlackRock’s IBIT fund generated the most notable data of the week with a net outflow of approximately $240 million. This amount represents almost half of the total outflows, providing a strong indicator of how perception has changed in the ETF market.

Market experts do not consider this development to be unique to crypto. The volatile movement in Bitcoin prices, uncertainties regarding the US Federal Reserve’s monetary policy, and ongoing macroeconomic pressures on a global scale directly affect investor behavior. In particular, rising bond yields and the strengthening dollar are among the factors limiting demand for highly volatile assets. Nevertheless, it is emphasized that these outflows from ETFs are not the sole determining factor for the long-term outlook. According to analysts, spot ETFs are, by their nature, products that are quite open to short-term capital movements. It is recalled that there have been periods in the past when strong fund inflows were seen after outflows of similar scale. In the coming period, attention will be focused on inflation data to be released from the US and messages from Fed officials. These topics will be critical in determining whether institutional investors will resume risk-taking and the direction of demand for spot Bitcoin ETFs.It will play a crucial role. At this stage, the overall picture suggests the market has entered a wait-and-see mode.

Historic Step by the Bank of Japan

The Bank of Japan (BoJ) has made a radical change in its monetary policy, which has long been closely watched by global markets. Following its meeting in December 2025, the bank increased its policy interest rate by 25 basis points to 0.75%. This decision was a strong step confirming the effective end of Japan’s nearly thirty-year period of negative interest rates.

This move has symbolic significance not only for the Japanese economy but also for global financial stability. Having pursued an ultra-loose monetary policy for years due to deflation, weak domestic demand, and low wage growth, the BoJ recently changed its policy direction as inflation dynamics became more persistent. Bank officials emphasized that price increases are no longer limited to temporary factors and that rising wages support economic recovery. Statements from the BoJ specifically noted that this interest rate increase is not the beginning of an aggressive tightening process. While the overall framework of monetary policy remains supportive, the message conveyed was that negative interest rates have lost their meaning under current economic conditions. The stabilization of energy costs, the recovery in domestic consumption, and the normalization of global trade were among the main factors behind the decision. The initial market reaction was seen in the currency market. The Japanese yen strengthened against other major currencies, while government bond yields also rose. This development has revived questions about the future of carry trades, which have been based on low-interest yen for many years. Experts suggest that interest rate hikes in Japan could have more significant effects on global capital movements over time. From the perspective of risky assets and cryptocurrency markets, this decision is seen as a harbinger of a gradual tightening of global liquidity conditions. Japan’s long history as a key indirect provider of liquidity to the global financial system makes this step by the BoJ even more critical. According to analysts, the BoJ will avoid hasty actions in the future and will base its decisions on economic data. While interest rate increases are expected to proceed in a limited and controlled manner, Japan’s official exit from negative interest rates has already taken its place as a significant turning point in monetary policy history.

Ripple CTO David Schwartz Highlights XRP

Ripple’s Chief Technology Officer, David Schwartz, stated that he does not believe crypto projects should be judged solely on their market price, arguing that the real metric should be real usage and adoption. In a social media post, Schwartz pointed out that the XRP Ledger has processed over 4 billion fast and low-cost transactions to date, highlighting this as a rare and tangible success in the industry.

According to Schwartz, a large part of the crypto ecosystem still operates with a speculative valuation approach. He stated that price movements are mostly shaped by short-term expectations and market psychology, arguing that the technological capacity offered by networks, transaction volume, and real-world usage rates are much more permanent and meaningful indicators. At this point, he stated that XRP is in a more functional position compared to many competing blockchains, especially in cross-border payments and financial infrastructure solutions. David Schwartz also made a special point about the technical efficiency of the XRP Ledger. The fact that transactions are completed in seconds and costs remain at extremely low levels makes the network an attractive solution for institutional actors. Schwartz stated that these advantages are not only theoretical potential; they are actively used by banks, payment companies, and financial institutions. According to him, the number of transactions exceeding 4 billion is a strong response to the criticisms that XRP has not been sufficiently adopted. The Ripple CTO also pointed out that the perception of “high price = success,” which is frequently encountered in the crypto markets, can be misleading. Stating that some projects offer limited use despite high market capitalization, Schwartz said that XRP, on the other hand, offers an infrastructure that works independently of price fluctuations and provides solutions to real needs. He added that this approach aligns with Ripple’s long-term vision of “blockchain focused on real-world problems.”

Record Number of Mergers and Acquisitions in the US Crypto Sector in 2025

The US crypto sector experienced one of its busiest merger and acquisition (M&A) periods ever throughout 2025. A total of 267 merger and acquisition transactions took place during the year, with these deals.

The total value of the transactions was recorded as $8.6 billion. These figures are interpreted as a significant indicator that the crypto markets are rapidly progressing towards institutional maturity. According to experts, there are several key factors behind this increase. Firstly, clearer regulations in the US have allowed large companies and investment funds to enter the crypto sector with more confidence. The reduction in uncertainties has made companies operating in infrastructure, custody services, blockchain software, and data analytics attractive acquisition targets. A significant portion of mergers and acquisitions occurred between institutional service providers and blockchain infrastructure companies. Instead of entering crypto from scratch, large finance and technology firms incorporated existing expert teams and ready-made technologies. This strategy saved time and facilitated regulatory compliance. Analysts state that the total transaction volume of $8.6 billion is not only a financial magnitude but also a symbolic threshold showing the acceleration of crypto’s integration with mainstream finance. The increasing active role of banks, asset management companies, and payment giants in this process reveals that the crypto sector is moving beyond being a “niche” area. However, the increasing mergers and acquisitions also bring some concerns. Proponents of decentralization argue that the sector’s increasing control by large players could reduce competition in the long run. On the other hand, the institutional perspective agrees that this consolidation process will bring stability, trust, and sustainable growth to the sector.

Data from 2025 clearly shows that the US crypto sector has now passed the early experimental stage and has become an institutional-scale industry. Experts expect this trend to continue in the coming years and for larger-scale acquisitions to come to the fore.

Strategy CEO Doesn’t Back Down

Strategy (MSTR) continues to maintain its strategic stance despite the sharp pullback in Bitcoin price. While the company’s balance sheets suffered significant losses after Bitcoin fell below the $87,000 level, Strategy CEO Michael Saylor drew attention with his message to the markets. The CEO emphasized that short-term price movements have not changed the company’s long-term Bitcoin vision. Strategy stands out as one of the most aggressive institutional players in recent years, positioning Bitcoin as its primary reserve asset. The company has regularly purchased BTC through methods such as borrowing and capital increases, an approach that has garnered both support and criticism.

It is estimated that Strategy has incurred billions of dollars in paper losses in its portfolio as Bitcoin prices retreated from their peak levels. In a statement by the CEO, it was stated that Bitcoin’s short-term volatility is “expected and manageable” for the company, while emphasizing that the main focus is on long-term value preservation and the narrative of digital scarcity. The statements also highlighted the view that Bitcoin remains a strategic asset in the face of global monetary policies, inflation, and uncertainties in the financial system. Market analysts note that while Strategy’s stance may cause volatility in the company’s shares, it is an important signal of institutional commitment for the crypto ecosystem. Especially in a period of increased interest in Bitcoin through ETFs and institutional funds, Strategy’s position carries symbolic significance for the sector.

$292 Million Ether Transfer Unsettles the Market

The mysterious investor known as the “10/10 whale” in the crypto markets, who made nearly $200 million in profits with short positions opened just before the sharp market crash on October 10th, has come back into the spotlight. On-chain data revealed that this whale transferred $292 million worth of Ether to the Binance exchange today.

This large transfer has raised the possibility of selling pressure in the market and created uncertainty among investors. This move, occurring especially during a period when the Ether price was hovering around critical support levels, has led to speculation that the whale may be preparing a new position.

While analysts emphasize that such large-scale transfers do not always directly mean selling, they note that the whale in question is being closely watched by the market due to its past timing. The “10/10 whale’s” previous moves have shown a high correlation with market downturns. On-chain data experts say that whale movements should be closely monitored not only in terms of price, but also in terms of open positions and funding rates in derivative markets. Expectations are strengthening that volatility in the Ether market may increase in the coming days.

Russia and the US on Nuclear Power Plant Discussions

Russia and Energy diplomacy between the United States and Russia, which had been stagnant for a long time, has revived over nuclear power plants, and a Bitcoin detail that emerged from the discussions has attracted international attention. The contacts between the parties regarding nuclear energy cooperation, technology sharing, and financing models, indirectly bringing up digital assets alongside traditional payment and financial systems, have once again highlighted the intersection of energy, geopolitics, and cryptocurrency. The main focus of the discussions is on new generation nuclear power plant projects, the modernization of existing facilities, and the security of fuel supply chains. Russia, with its nuclear technology and construction experience, is a significant global player; while the US is closely monitoring these contacts to both enhance its energy security and maintain its strategic influence. However, this time, the topics on the table were not limited to a purely technical and diplomatic framework. New Approaches in Financing and Payment Models

In recent years, sanctions imposed on Russia have made alternative solutions necessary, especially in the financing of large-scale energy projects. At this point, new payment and value transfer methods that will reduce dependence on traditional banking systems have begun to emerge. Bitcoin and other digital assets, even if not used directly as a means of payment, are considered a potential tool for cross-border value transfer, balance sheet diversification, and financial flexibility.

According to diplomatic sources, Bitcoin is not at the center of nuclear power plant agreements; however, its mere mention among alternatives cited when discussing the fragility of financial systems and sanctions risks is seen as a significant signal. This indicates that crypto assets are no longer just a matter of investment or speculation, but have become an indirect part of geopolitical discussions.

Energy, Bitcoin, and Geopolitical Connection

While Bitcoin’s energy consumption has long been a subject of debate, its association with nuclear energy presents a contradiction. On the one hand, there are nuclear power plants offering low-carbon, uninterrupted energy production; on the other hand, there is Bitcoin mining, known for its high energy demands. In recent years, the idea of using nuclear or surplus energy capacity for digital asset mining has been voiced more loudly in some countries. Russia’s vast energy resources and nuclear infrastructure theoretically offer a favorable ground for such scenarios. On the US side, the effects of Bitcoin on national security, energy policy, and financial stability are being addressed more cautiously.

Therefore, the indirect inclusion of Bitcoin on the table reveals the difference in the two countries’ perceptions of technology and finance. According to experts, this development is an indication that crypto assets are increasingly becoming a point of reference in global diplomacy. Even if Bitcoin is not a direct element of an agreement, its inclusion in discussions about sanctions, payment systems, and energy security shows that digital assets are now an element that cannot be ignored. Especially in strategic sectors such as energy, the diversification of financing models and the discussion of alternative systems indicate that cryptocurrencies may play a more visible role in interstate relations in the long term.

Historic Step from CFTC

The US Commodity Futures Commission (CFTC) has taken a landmark decision for cryptocurrency markets. For the first time, the commission approved the trading of spot crypto assets such as Bitcoin on officially registered US exchanges. This step paves the way for the integration of not only Bitcoin but also other crypto assets into regulated markets in the future, signaling a long-awaited structural transformation in the market. The decision aims to build trust in spot crypto markets, which institutional investors have been hesitant to enter due to regulatory uncertainty. The ability to buy and sell Bitcoin spot on exchanges under CFTC supervision is of great importance in terms of transaction security, transparency, and market oversight. According to experts, this development will accelerate the integration process of crypto assets with the traditional financial system and facilitate institutional entry into the market. With spot transactions subject to CFTC regulation, investors will now be able to trade in a more secure environment against sudden price volatility and manipulation risks. Furthermore, it is expected to have ripple effects such as increased market liquidity, a broader investor base, and the development of new financial products. Some analysts suggest that this decision will also pave the way for the emergence of other products similar to spot Bitcoin ETFs in the future. This step is considered one of the biggest steps taken by the US towards creating a clearer framework for crypto regulation.

Voluntary Day in US Spot Bitcoin ETFs

Spot Bitcoin ETFs traded in the US recorded a total net outflow of $60.48 million on the last trading day. The capital withdrawal across the funds indicates increased short-term profit taking and investors’ cautious approach to the market outlook. Despite this, BlackRock’s flagship IBIT was the standout product of the day, attracting $28.76 million in inflows alone. Competition among large funds had intensified, particularly in recent weeks, with the rise in ETF volumes. However, this time, the largest outflow, $44.03 million, came from Grayscale (GBTC), reflecting a shift in market risk perception.

It is not yet clear whether a significant portion of the capital withdrawn from GBTC has shifted back to the ETF group or the spot market. Analysts interpret IBIT’s strong performance, despite the outflows, as a signal that institutional demand continues. While volatility may persist in the short term, it is predicted that Bitcoin ETFs are increasingly solidifying their structural position in traditional markets and that total fund movements can maintain their growth trend in the long term.

Station Rebuys Again

Station (formerly MicroStrategy), known for its Bitcoin investments, continues its aggressive BTC accumulation strategy without slowing down. The company spent approximately $963 million by purchasing an additional 10,624 Bitcoins in just one week. This brought the company’s total BTC reserves to 660,624, reaching their highest level in history.

The company’s purchasing pace has accelerated significantly recently. Even with volatile Bitcoin prices, Strategy positions BTC as a long-term store of value, placing it at the center of its reserve strategy. This approach makes the company the publicly traded institution with the largest Bitcoin holdings.

According to analysts, the company’s large-scale purchases indicate that institutional confidence in Bitcoin remains strong. However, high leverage and borrowing costs remain critical considerations for the long-term sustainability of the strategy.

Circle Obtains Official License from Abu Dhabi Global Market

Circle Internet Group, a major player in the stablecoin ecosystem, has expanded its official operations in the Middle East by obtaining a money services provider license from the Abu Dhabi Global Market (ADGM). This license will allow the company to offer services under a regulated framework in the region and bring its stablecoin products, including USDC, to institutional and retail financial markets. Known for its crypto-friendly regulatory approach, the UAE’s ADGM is becoming a strategic hub for global fintech companies.

Circle’s expansion into the region could both increase the use of dollar-based digital assets and contribute to the growth of stablecoin-based international payment flows. According to experts, this step is a crucial component of Circle’s global expansion plans. The company’s expansion into markets outside the US Targeting the markets adds a more international dimension to stablecoin competition and paves the way for USDC to play a more effective role in the global financial infrastructure.

Strive Announces $500 Million Plan to Increase Bitcoin Reserve

As institutional Bitcoin accumulation gains momentum, US-based investment company Strive announced a $500 million stock sale plan to grow its existing BTC holdings. This move further strengthens the company’s goal of positioning Bitcoin as a strategic reserve asset and signals a deepening of the digital reserve concept in institutional asset management.

According to Strive’s statement, the capital obtained will be used directly for Bitcoin purchases, further expanding the company’s already significant BTC portfolio. Thus, Strive aims to gradually transform its balance sheet towards a digital asset-based structure. This approach has attracted attention in the market, particularly due to its similarity to MicroStrategy’s aggressive Bitcoin accumulation strategy, which it has pursued for many years. Company management emphasized their belief that Bitcoin is a scarce and secure store of value that provides long-term protection against inflation. The fact that the $500 million plan will be implemented despite fluctuations in the BTC price demonstrates Strive’s high level of confidence in this asset.

Analysts note that this decision indicates that institutional Bitcoin adoption has entered a new phase, with companies increasingly moving BTC into the same category as gold and cash reserves in their balance sheet management. If this step is realized, Strive could move up in the rankings of institutional Bitcoin ownership and position itself as one of the pioneering companies in the digital reserve concept. Furthermore, such an acquisition is expected to create additional liquidity in the market and support investor confidence. Strive’s plan is considered critical not only for the company but also for general institutional finance trends, as more and more companies are beginning to consider digital assets as a strategic insurance and alternative investment vehicle in their portfolios. If the $500 million capital increase is completed, this step could be recorded as a significant milestone in the history of institutional Bitcoin adoption.

Japan Imposes Mandatory Insurance and Reserve Requirements on Crypto Exchanges

Japan is enacting a significant regulation aimed at increasing security and protecting investors in the digital asset market. Under the new law, crypto exchanges operating in the country will be required to hold insurance policies or financial reserves that fully cover user losses in the event of a hack or asset breach. This step is considered one of the most comprehensive security regulations Japan has been working on for a long time.

With this decision, taken after a tiered oversight process, the government aims to raise security standards in the digital asset sector on a global scale. According to experts, the regulation is not only a technical requirement but also represents a strategic approach aimed at providing clear protection to investors while integrating crypto into Japan’s long-term financial system.

A Policy Shaped by Security Vulnerabilities

The fundamental starting point for the new rule was the billions of dollars lost by investors in exchange attacks worldwide in recent years. The Japanese government intervened, emphasizing that a large portion of these losses were not covered by the platforms and that the burden fell directly on the users. Exchanges are now required to: Maintain reserves to ensure the full reimbursement of stolen digital assets,

or enter into insurance agreements to secure the same coverage.

These conditions aim to prevent user funds from remaining vulnerable to risky market conditions or technical vulnerabilities. Thus, exchanges will move beyond being merely trading platforms and will have to assume actual responsibility in terms of security and fund management.

SEC Prepares for a Historic Restructuring of Crypto Policies

The US Securities and Exchange Commission (SEC) is undergoing a significant transformation regarding digital asset regulations. In recent statements, the agency’s new chairman, Paul Atkins, indicated that the SEC’s stance on crypto assets is being re-evaluated and that a serious policy shift in this area could be seen within the next year. This announcement has caused a major stir in both traditional markets and the crypto ecosystem. This is because the SEC has been involved in numerous legal battles with digital asset projects for many years, and the uncertainty regarding whether certain tokens should be considered securities has created significant tension in the sector.

The framework presented by Atkins aims to put this approach on a clearer footing. A new approach is being adopted regarding key topics such as the classification of digital assets, the registration requirements for crypto companies, the licensing processes of exchanges, and investor protection.

A regulatory model is being prepared. It is believed that this process could replace the rigid, punitive approach that suppresses the market with a more institutional, transparent, and guiding system. In particular, the uncertainty and lack of regulation, which are major obstacles to institutional capital’s entry into crypto, could be eliminated as these steps accelerate. Although preparations have reportedly begun within the SEC, a detailed roadmap has not yet been publicly released. However, the institution’s approach to digital assets has so far been characterized by strictness and a punitive focus. The new approach could signal a period where innovation is supported and companies can operate within more defined boundaries. If this change is implemented, the US could once again become one of the central countries in global competition regarding crypto policies. On the other hand, it is being discussed that this transformation will not be limited to legal regulations but may also include new frameworks that will facilitate capital market institutions’ access to digital assets. In short, statements from the SEC indicate that the structural transformation the crypto industry has long awaited may be on the horizon. Official announcements in the next few months have the potential to directly impact not only US companies and investors but also the global ecosystem. Therefore, market participants are focused on the direction the legal framework will take. If a clearer and more workable regulatory model emerges as expected, this change could become one of the most critical turning points for the crypto economy in recent years.

Related Articles

Spot Crypto ETFs: Global Rise and Turkey’s Roadmap