In this article, I will discuss how memecoins currently work, why successful ones must evolve into social currencies, and the impact social currencies will have on crypto.

The last 18 months in the crypto market have been extremely turbulent, and we’ve witnessed the rise of meme coins during this period. Of course, memecoins aren’t new – they are actually one of the oldest forms of crypto – but they have once again proven to be a preferred tool to engage with crypto’s most innovative mechanisms.

While memecoins may seem pure and almost artistic in nature, they also carry a darker side. No, I’m not talking about insiders or conspiracies – this is a systemic issue that affects the entire crypto asset class. The real problem is the lack of effort, wasted potential, and complacency in creating memecoins. Maybe I’m too idealistic, but I don’t want to accept that memecoins will remain the way they are today – at least, I hope they won’t.

I believe intellectual property (IP) is the Trojan horse for crypto adoption. Because IP has the ability to create trust and credibility. Like NFTs, memecoins are also a form of IP. These tokens can reach people’s hearts and minds and bring crypto to the masses. However, most memecoins remain stagnant, generic, and shallow rather than pushing innovation forward. In this state, they risk doing more harm than good. For the category to reach its full potential, memecoins must evolve. That evolution should lead to social currencies – moving from random volatility to scalable, enduring, and beloved IPs.

My goal is not to replace memecoins with social currencies entirely. On the contrary, I argue they need one final step added to their growth roadmap. They need to transform from unproductive on-chain images into meaningful and intentional social assets. I believe some tokens have already begun moving in this direction. In this article, I will analyze how memecoins function, why successful ones must evolve into social currencies, and how this evolution will benefit crypto.

What Is a Social Currency?

A social currency is a tokenized asset that represents value within a community, used to incentivize participation, reward engagement, and strengthen community loyalty. It functions similarly to traditional currency, but its value is shaped by social interaction, reputation, and influence.

Simply put, a social currency is the fundamentally-driven version of a memecoin. It aims to generate lasting value through meaningful communities, not through short-term volatility.

Memecoins vs. Social Currencies

Memecoins don’t create virality — they monetize existing virality. Social currencies build their own virality through emotional connection, partnerships, and integrations.

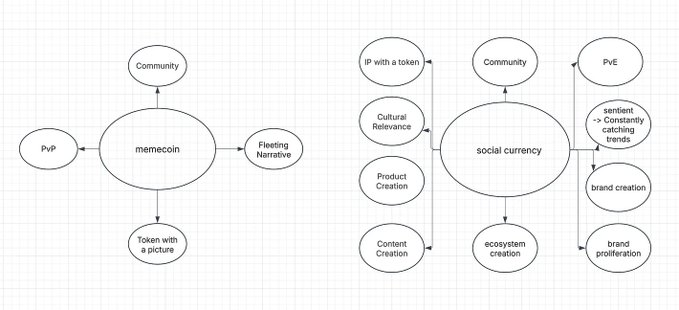

A memecoin’s lifecycle typically looks like this:

Idea → token launch → community → narrative → narrative fades → community dissolves

For a social currency, the lifecycle evolves like this:

Idea → token launch → community → narrative → brand → expansion → ecosystem → global adoption

Every social currency may begin as a memecoin, but must evolve once momentum builds. This is not about replacing memecoins, but about their natural evolution. Memecoins with real value become the foundation of social currencies. Anyone can launch a memecoin, but growing it into something enduring is a different task.

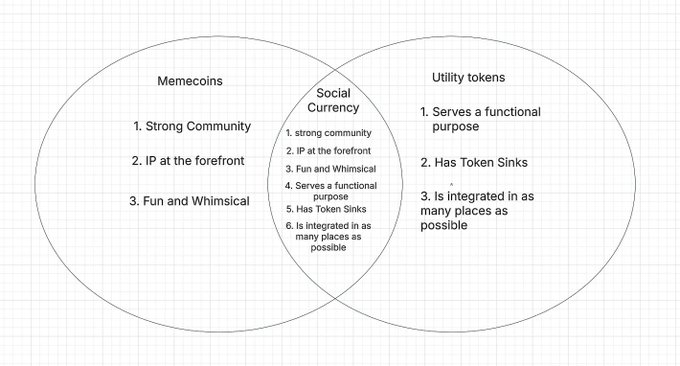

I like this chart because it shows that social currencies aren’t trying to replace memecoins, but rather represent their evolution. Social currencies are memecoins with real value behind them. Anyone can launch a memecoin, but only the best ones can create lasting value.

If you believe cryptocurrencies will continue appealing to the retail investor class, then you inherently believe in the importance of memecoins. But if you believe institutional capital will eventually enter alternative assets, then you must accept that fundamentally-sound projects will rise to prominence. Social currencies maintain the retail appeal of memecoins while being strong enough to attract institutional interest. A social currency is an asset that combines the energy of memecoins with the structural advantages of utility tokens.

When we analyze the disadvantages of memecoins, their greater potential actually becomes clear. However, the community seems united around the belief that memecoins should “do nothing.” I refuse to accept this mindset as a valid norm for the future of the category. To understand why, let’s look at what limits memecoins and how transitioning to social currencies can solve these issues:

Disadvantages of Memecoins:

- Stagnation — momentum fades once the trend ends

- Memecoin stigma — 99% of participants lose money, not suitable for long-term holding

- PvP nature — short-term profit battles between participants

- Lacks infrastructure to onboard new users

- Hope-driven but empty narratives — no real fundamentals

- Success mostly relies on luck

Advantages of Social Currencies:

- They are intentional — they create trends, follow trends, and stay relevant

- They leverage memecoin momentum and add fundamentals — suitable for long-term holding

- PvE nature — built to onboard new users and grow crypto

- Drive lasting demand through brand partnerships, content projects, and IP expansion

- Creates real value and builds conviction

- Success relies on fundamentals, not just luck or narrative

Conscious vs. Unconscious:

To me, the core difference between a memecoin and a social currency is intelligence: the ability to stay relevant over time. Social currencies are intelligent; memecoins are not. This is why traders and investors should pay attention to social currencies. Intelligence \= interest \= attention \= momentum. Unless you become a historical outlier like DOGE, anything lacking intelligence will fade over time.

Some of you may be thinking: “I don’t want my memecoin to carry execution risk.”

This mindset emerged among NFT collectors in 2020 and still persists. But my objection is simple: something with no execution risk relies only on luck. And assets that rely on execution almost always outperform assets that rely on luck. Whoever can apply it wins.

The Future of Social Currencies

For memecoins to reach their true potential, they need one final evolutionary step to transform into social currencies over time. Tokens that create culture, build strong community bonds, and integrate into the real world will define the next era of crypto.

The shift from stagnant, speculative assets to dynamic, interactive ecosystems is not only necessary — it is inevitable.

So now you must ask: who will lead this movement?

Related Articles

What is HyperGPT (HGPT)?

Ether.fi (ETHFI) Nedir?