Trading Logic of Altcoins: Fundamental Analysis and Technical Analysis

In the crypto market, altcoins involve high risk and high rewards. Unlike more mature Bitcoin, its prices can be easily influenced by news and large investors. This article will teach you how to build a customized altcoin trading strategy using three methods: fundamental analysis, technical analysis, and smart money tracking.

In the cryptocurrency market, altcoins are generally considered high-risk assets with the potential for high returns. Many traders realize that Bitcoin-centric market perspectives do not always yield effective results when trading altcoins. While Bitcoin is more stable and mature, altcoins are shaped by various use cases, visions and themes. This makes altcoin prices more sensitive to project developments, news flow and large wallet movements. Therefore, a more specific and multi-layered strategy for trading altcoins is needed.

This article aims to guide beginners through the process of creating their own altcoin trading strategies using methods such as fundamental analysis, technical analysis and tracking on-chain smart money wallets.

Fundamental Analysis: Understanding the Tangible Value of Altcoin Projects

Fundamental analysis focuses on assessing the intrinsic value and long-term potential of a crypto project. This process takes into account factors such as team competence, the technological infrastructure of the product, token economics and market demand. Compared to Bitcoin, which is often influenced by macro factors, altcoins are similar to early-stage venture stocks, whose performance largely depends on the development of the project and the activity of its ecosystem.

What to focus on in fundamental analysis?

Philosophy and Vision

It is important to understand the project team’s background, development experience and reputation within the community. A trusted team and a clear vision can increase the project’s chances of success. Review the official whitepaper and roadmap to verify the problems the project aims to solve and its future plans.

Technology and Product Application

Assess the level of technological innovation of the project and the current state of product implementation. For example, if a DeFi project already offers a working protocol, or a GameFi project has an active community of players, this can be a significant advantage. While the technological promise may be impressive, projects without real-world application may remain at the idea stage only and carry higher risk.

Data Indicators (On-chain Data)

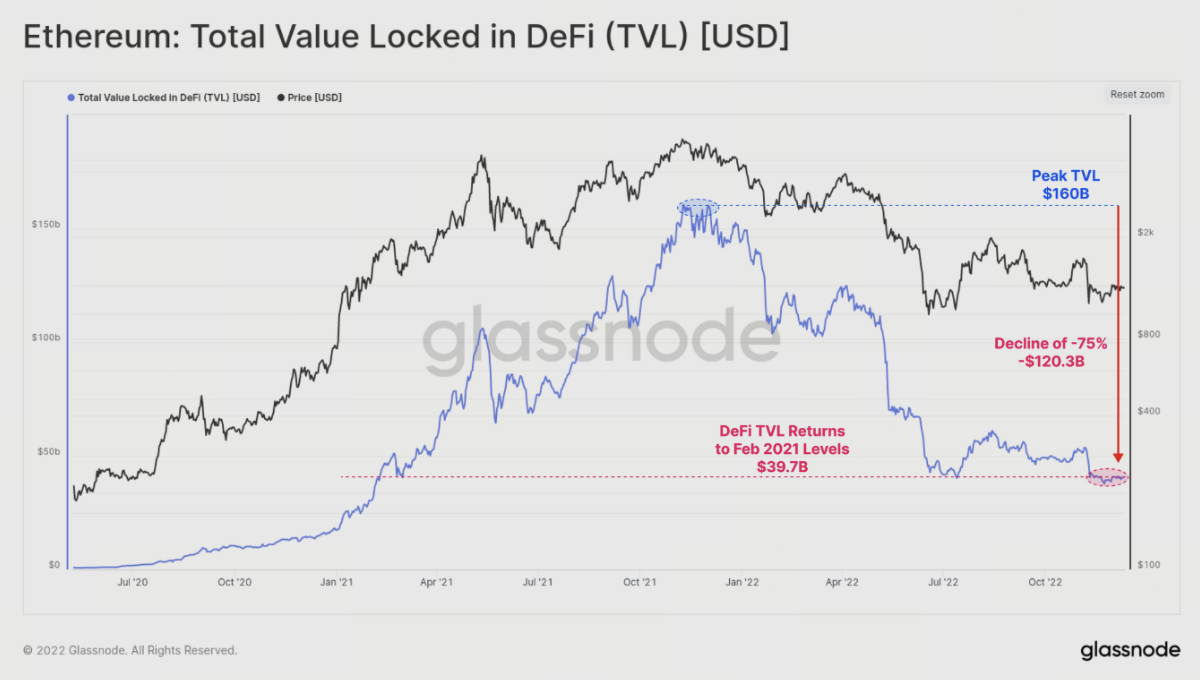

Use on-chain analytics tools to track the project’s key performance data such as the number of active addresses per day, trading volume and total value locked (TVL). These metrics show how much the project is actually being used. For example, if a DeFi platform’s TVL is increasing, it means that more funds are flowing into the protocol, indicating strong fundamentals. On the contrary, a decrease in utilization generates warning signals. To give an example from the DeFi ecosystem, in the 2022 bear market, total TVL fell below $50 billion, 75% from its peak value, revealing serious capital outflows. In such cases, caution should be exercised even if technical indicators give positive signals.

A significant drop in DeFi TVL in 2022 (Source: Glassnode)

Tokenomics

Analyze the token’s supply mechanism and distribution model, total supply, inflation rate, unlock schedule and use cases. A well-designed tokenomics structure (e.g. deflation mechanisms and a clear usage model) can contribute to the long-term appreciation of the token. On the other hand, if the team holds a high percentage of tokens or the unlocking schedule is concentrated in certain periods, there may be a risk of selling pressure.

Community and Market Hype

Monitor community engagement and market interest surrounding the project. For example, one could look at indicators such as the number of members and level of interaction in the project’s X (Twitter) or Discord community, media coverage, etc. A highly active community often indicates strong market interest. However, one should be wary of hype-driven projects that do not deliver tangible progress.

Fundamental Analysis in Practice

Using Lido Finance as an example, let’s show how to use fundamental analysis to determine whether a DeFi project is worth pursuing:

First, let’s look at the background of Lido Finance. The project was founded in 2020 by Konstantin Lomashuk, Vasiliy Shapovalov and Jordan Fish. They have worked as core engineers at leading crypto companies such as Parity and ConsenSys. This shows that they have not only technical expertise but also a strong network and resources in the industry, which reduces the risk of project failure.

On the technology and product side, Lido’s liquidity staking derivative called stETH already supports major networks such as Ethereum; it also integrates with networks such as Polygon and Solana, and connects with over a hundred DeFi protocols. This indicates that the product has a wide range of uses and creates a competitive advantage in the ecosystem.

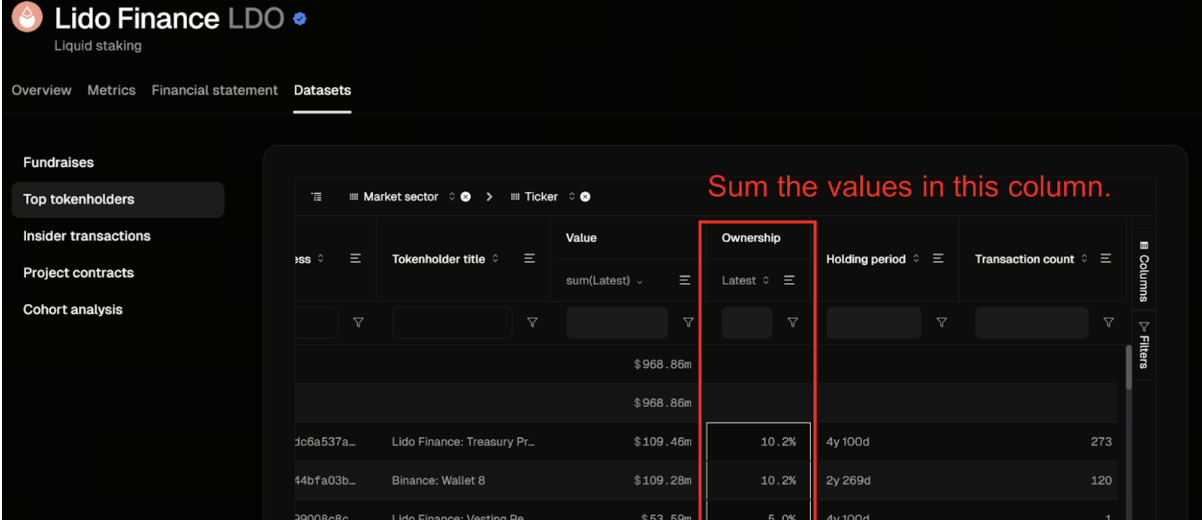

In tokenomics terms, LDO’s total supply is 1 billion tokens. Of this offering 36.32% was allocated to the DAO treasury, 22.18% to investors and %15% to the founding team. To track LDO token distribution in real time, the “Top Token Holders” dashboard is available on Token Terminal:

- Open the Token Terminal site → Search for Projects → “Lido Finance” → Go to “Datasets” → Click on the “Biggest token holders” tab

- In the “Ownership” column, you can see the percentage of LDO each address controls.

This data is updated daily and shows that the top 100 wallets hold 84% of the total LDO supply, which implies a high concentration. The high concentration of token ownership in a few wallets points to centralization of governance power and potential risks. Therefore, it is important to closely monitor projects’ locked token calendars and unlocking schedules.

Query the asset allocation of the top token holders (Source: Token Terminal)

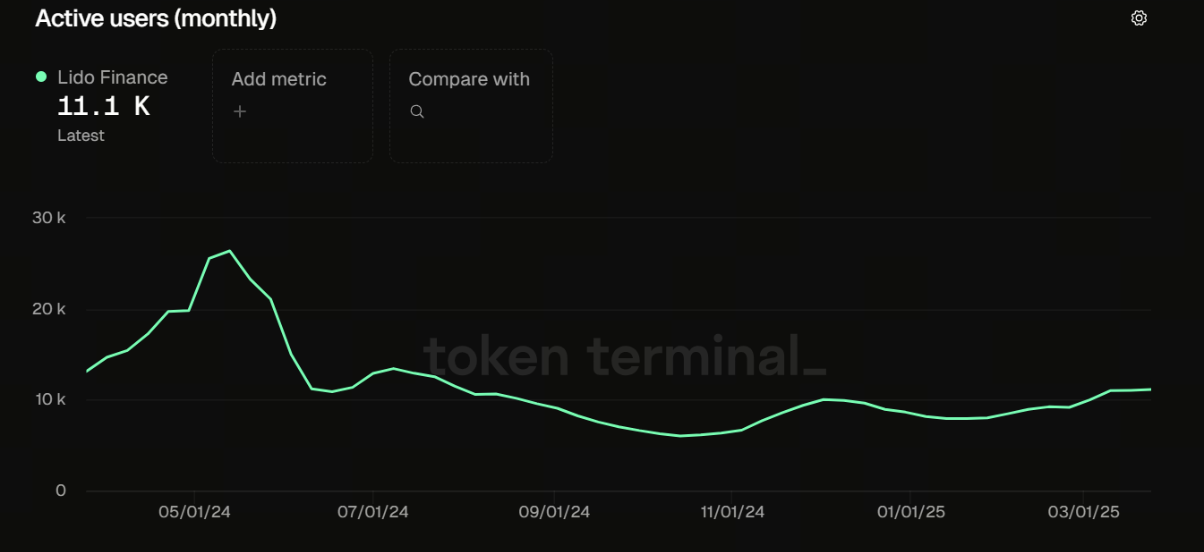

In terms of market excitement, according to Token Terminal → Metrics data, Lido’s Monthly Active Users (MAU) surpassed 25,000 in May 2024 but quickly dropped and currently stands at approximately 11,100. This significant fluctuation shows that Lido’s popularity is not being sustained and reveals issues of user retention problems and declining community engagement. It is important to monitor how the project addresses and increases long-term use value and engagement.

Lido’s monthly active users are decreasing (Source: Token Terminal)

You can also use the Token Terminal → Metrics to check Lido’s Total Value Locked (TVL). Lido’s TVL has been steadily decreasing since the end of 2024, dropping from almost $40 billion to around $18 billion. This indicates that a large amount of capital has exited the protocol, user engagement has declined and market confidence has been shaken. It is important to carefully avoid potential fundamental weaknesses and the risk of eroding the position of competitors.

Lido’s TVL has been steadily decreasing since the end of 2024 (Source: Token Terminal)

Overall, Lido’s fundamental dynamics still have sufficient strength to support the project, but some key indicators have weakened recently. It is therefore recommended to adopt a “wait and observe” strategy: Wait for key metrics such as TVL (Total Value Lock) and MAU (Monthly Active Users) to stabilize and decentralization of governance to improve before considering the timing of a phased investment.

In this context, it is clear to see how fundamental analysis is an effective tool for determining whether an altcoin project is “worthwhile” or not. Especially for beginner traders, studying a project’s whitepaper and watching on-chain data trends is far more valuable than blindly following market rumors. Remember: Fundamentals represent long-term strength and prices will converge to true value over time. Before investing in an altcoin, asking yourself whether the project has a truly sustainable vision will increase your chances of success in your investment decisions.

Technical Analysis: Interpreting Chart Trends and Perfecting Timing

Next to fundamental analysis, technical analysis (TA) is also a critical tool in altcoin trading. Technical analysis focuses on identifying trends and patterns on a chart based on market data such as price movements and trading volume. This analysis helps traders to capture trading opportunities more accurately. In highly volatile altcoins, prices can double or fall sharply in a very short time. Therefore, learning to read charts is extremely important to be able to adapt to the current trend and make timely take-profit or stop-loss decisions.

Common Elements of Technical Analysis

Trends and Patterns

As a first step, determine whether the altcoin is in a bull (bullish) or bearish (bearish) trend. You can use indicators such as moving averages (for example, the 50-day MA) to understand whether short and long-term trends are moving in the same direction. Watch out for classic chart patterns such as double bottom, triple top, symmetrical triangles and shoulder-head-shoulder. For example, if the price of an altcoin forms a triple bottom pattern and breaks above the neckline, this is usually considered a signal of an upward trend reversal.

Moving averages above, bullish (Source: Gate Learn Creator John)

Support and Resistance

Using candlestick charts, identify the main support and resistance levels with intense highs and lows. Due to the high volatility of altcoins, support/resistance levels are often battlegrounds for bulls and bears. A level that repeatedly rises is strong support, while a price that fails to break and falls back suggests strong resistance. When the price breaks through a resistance zone, a support/resistance reversal usually occurs where the previous resistance becomes support. When you enter a trade, it is usually safer to buy near the support zone.

Support and Resistance Zones (Source: Gate Learn Creator John)

Technical Contributions

Technical indicators such as RSI (Relative Strength Index), MACD and Bollinger Bands can provide signals to detect overbought/sold zones or momentum shifts. For example, RSI above 70 usually indicates overbought conditions (risk of a potential correction), while below 30 can mean oversold (potential rebound).

However, it is important not to rely solely on these indicators, but to evaluate them in conjunction with trend analysis. For example, you can avoid misleading signals by lowering the thresholds for RSI to 80 and 40 in a bull market and 60 and 20 in a bear market.

In addition, analysis of a single time period can often give false signals. It is therefore advisable to use a multi-timeframe verification method. For example, if the 30-period EMA (Exponential Moving Average) moves above the 90-period EMA, confirm that the 4-hour RSI is above 65 and the weekly MACD shows the “golden cross” pattern. These combined conditions can be considered a strong bullish entry signal, increasing trading success rates and minimizing risks. This strategic approach enables traders to time their trades more precisely and make decisions unaffected by market noise.

Transaction Volume

Trading volume is a critical but often overlooked metric in technical analysis. Supporting price movements with high trading volume increases the strength and sustainability of the trend. Conversely, sudden price rises or falls on low volume are usually weak and temporary.

Whenever you observe an altcoin breaking an important resistance level, always check to see if the breakout is supported by volume. A breakout on strong trading volume could signal sustainable upside. However, moves that occur on low volume often carry the risk of a “fake breakout”. It is therefore important to follow price increases not only on a chart basis but also with volume support.

Technical Analysis in Practice

By applying the main points above, we can develop a systematic technical trading strategy for altcoins. Let’s use LDO as an example to explain the practical steps. Here is LDO’s daily chart:

LDO Daily Chart (Source: Gate Learn Creator John)

Observe the overall trend of the LDO by using a platform like TradingView or by expanding the timeframe on a daily or weekly basis via the built-in candlestick chart offered by an exchange. At the moment, the price is continuously moving in a downtrend and is below the 50-day moving average, supporting this trend. However, the price has approached a clear support zone (dotted white line) and is showing signs of rebounding without a serious breakout. At the same time, the RSI indicator at lower levels may signal an oversold zone. The combined technical indicators support a possible trend reversal.

Based on this analysis, if you are bullish on the fundamental analysis side and intend to open a long position, you can develop a specific trading strategy: You can take a position if the price breaks the moving average to the upside with a strong trading volume. This move can be interpreted as a signal for the transition to the bull trend and the next target could be the previous high or higher. However, risk management is just as important as opening a position - if the price weakens and breaks below the critical support level, you should consider ending your position to avoid bigger losses.

If the LDO price moves up with a strong volume in the coming period, you can activate your strategy and buy gradually. Monitor the trading volume and market sentiment carefully in the following days: if the volume increases simultaneously with the price increase, this indicates a healthy uptrend and you can hold your position for longer. However, if volume is declining while the price is making new highs (price-volume mismatch), this could be a warning signal and partial profit-taking at these levels would be a sensible strategy. Technical analysis is a dynamic process that is shaped by constantly evolving market conditions, so traders need to be flexible.

There is one thing to remember when applying this principle: While each altcoin chart has its own characteristics, the logic of technical analysis remains universal. For beginners, it is best to proceed with the knowledge that altcoins are often sensitive to general market movements. Therefore, it is appropriate to start the analysis process with major assets such as Bitcoin and Ethereum. If the market is bearish overall, even the strongest altcoins can lose value.

Conversely, in bull markets, even weak projects can experience short-term upswings. However, some altcoins may exhibit price action independent of the broader market. For example, some leading DeFi tokens can be bullish even when Bitcoin is flat. In such cases, traders should use candlestick patterns to confirm the reality of buying pressure and whether key resistance levels have been broken. In conclusion, while technical analysis helps determine “when to buy and sell”, it should always be considered in conjunction with fundamental analysis to determine “which asset to invest in”. Integrating these two approaches will significantly increase the probability of success.

Risk Management and Position Control

Risk Hedging Mechanism

Given the high volatility of the altcoin market and its sensitivity to Bitcoin (BTC) and Ethereum (ETH) price movements, it is important to establish a systematic quantitative hedging mechanism to mitigate the risks associated with general market declines. For example, one can use the β coefficient for BTC/ETH quantitative hedging.

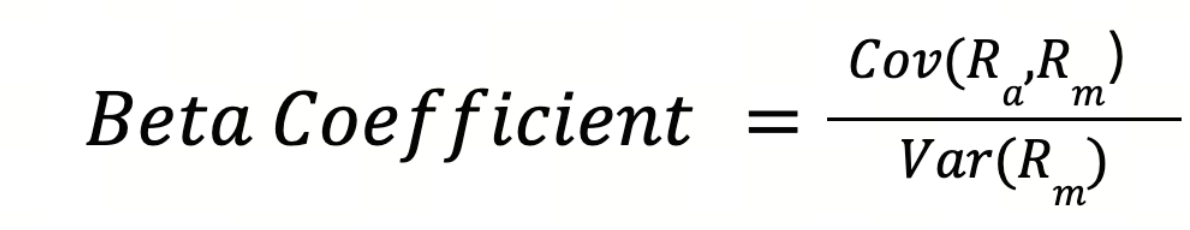

The β coefficient (Beta coefficient) is used to measure the price volatility sensitivity of an individual asset against the overall market or a reference asset (such as BTC or ETH). The formula used to calculate β is as follows:

β Coefficient Formula (Source: Wikipedia)

Ra \= Altcoin’s daily return (e.g., percentage of daily price change)

Rm \= Daily return on reference assets such as BTC or ETH

• β > 1 indicates that the altcoin has higher volatility compared to BTC or ETH.

• β ≈ 1 indicates that the altcoin moves in sync with BTC or ETH.

• β \< 1 implies that the altcoin has lower volatility.

Steps for a Risk Protection Mechanism:

- First, assess market sentiment and volatility by calculating the altcoin’s 30-day β coefficient relative to BTC/ETH.

- If this coefficient is above 1 and the market is extremely volatile, a hedging strategy should be put in place. For example, about 25% of the altcoin position could be hedged with short positions against BTC or ETH. This way, potential losses from altcoins can be offset by gains from short positions.

- Once the β coefficient returns to normal levels (below 1), these hedged positions are gradually closed and the portfolio is normalized.

This β-based hedging method can systematically reduce risk in your portfolio and limit losses during periods of high volatility.

Advanced Stop Loss Strategies

The use of common stop-losses can reduce trading efficiency. Therefore, more precise and case-specific stop-loss rules should be applied:

- When the altcoin price breaks below the critical support level, use a dynamic stop-loss method. At this point, the ATR (Average True Range) indicator can be used.

ATR is a technical indicator that measures price volatility.

- The stop point can be set, for example, at 2x ATR, which provides a flexible exit point according to the current volatility of the price.

- Monitor market liquidity. If the bid-ask spread suddenly rises above %5, it could be a sign of low liquidity and decreasing depth. Since this can lead to high price fluctuations, an emergency exit strategy should be activated and the position should either be quickly liquidated or minimized.

These advanced stop-loss and liquidity monitoring practices are highly effective in preventing severe and irreversible losses.

Smart Money Tracking: Creating Strategic Opportunities from Whale Movements

Smart money refers to experienced, well-informed large investors in the crypto market. These are often whale wallets, investment institutions, or key players that are early entrants into an industry. Thanks to the transparent nature of blockchain, large transactions carried out by such wallets can be tracked on-chain.

Why Should We Follow Smart Money?

Smart money often has first-hand knowledge or conducts detailed analysis. Large capital flows can have directional effects on the market.

For example, if a powerful whale starts to accumulate a certain altcoin heavily, it can drive the price up in a short time. Traders who follow these transactions in a timely manner may have the opportunity to profit by taking their positions at the right time.

We can also follow these wallets to learn from their investment strategies and revise our portfolios according to their movements.

• While some whales are interested in short-term meme coin speculation,

• Others may invest in long-term blue-chip DeFi projects.

Such differences are understood over time and allow traders to adapt their strategies to their own style. If you observe a whale significantly unloading an asset, this could be an early signal of potential negative news and may indicate that it is time to review the position.

Tools for Smart Money Tracking

Today, there are many on-chain analysis platforms available that enable individual traders to track such whale movements.

Lookonchain

Lookonchain is an on-chain analytics platform focused on monitoring whale transactions.

On social media platforms such as X (Twitter), he/she often shares content such as:

• “A whale bought this many X tokens”

• “An old wallet sent Y token to an exchange”

Example:

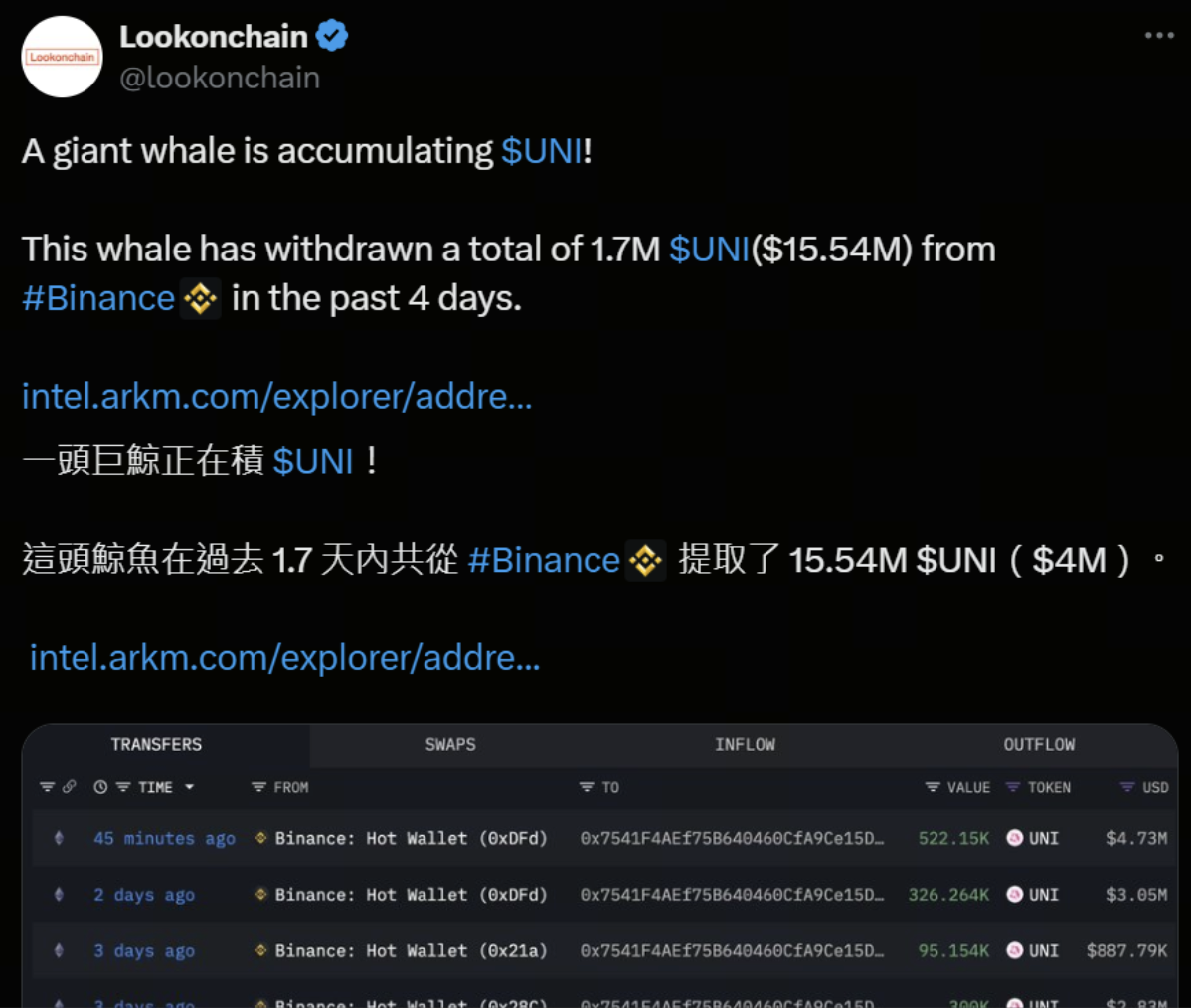

In February 2025, Lookonchain announced that a mysterious whale transferred 1.7 million UNI (approximately 15.54 million USD) from the exchange to a new wallet. This transfer signaled that the whale had increased its Uniswap position and had confidence in this project.

Since Uniswap is the largest decentralized exchange on Ethereum, such whale movements can often react early to anticipated positive developments. This information could mean a potential bull signal for investors.

Lookonchain Reveals Post Whale Movements (Source: Lookonchain Official X)

Arkham: De-anonymized On-Chain Intelligence

Arkham is an emerging on-chain analytics platform focused on de-anonymization. With Arkham’s tagged data, it becomes easier to identify which smart money addresses are worth following. The UNI token withdrawal mentioned in the previous example was detected and shared by Lookonchain using Arkham’s data tags. In addition, Arkham allows users to receive notifications when important transfers occur from addresses on their watchlist, so traders can follow whale activity in real time.

How to use Arkham?

- In the search bar on the home page, type the token name you want to track (for example, “UNI”).

- Scroll down to view the “top holders” section, which usually contains the addresses of important organizations, foundations or whales related to that token.

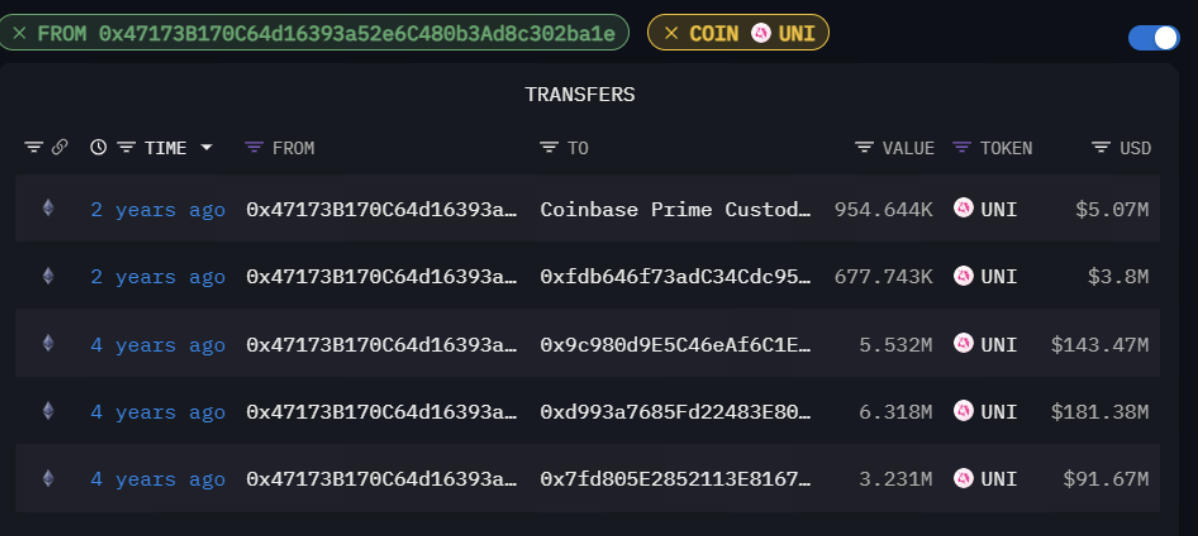

UNI Whale Addresses (Source: Arkham)

- On the side, there is a separate section with the asset transfer history of the token. Specific addresses or large transfers can be filtered in this field. For example, when you filter a whale address, you can see that there has been no major movement for the last two years.

Whale Address Asset Transfer Records (Source: Arkham)

- When you find an address worth following, you can put it on your watchlist. To do this, search for the relevant address on the Arkham homepage, then click on the “Create Alert” or “Track Address” buttons in the top right corner. Note: You need to register for the Arkham platform to use these features.

Nansen

Nansen is a popular and comprehensive on-chain analytics platform. One of its highlights is the Smart Money Tagging system that categorizes wallet addresses with machine learning and analyst notes. Nansen tags tens of thousands of wallet addresses of leading venture capital funds (VCs), experienced DeFi whales, arbitrageurs and early-stage investors. Thanks to this tagging, investors can get a quick insight into the background and potential investment intent of the address.

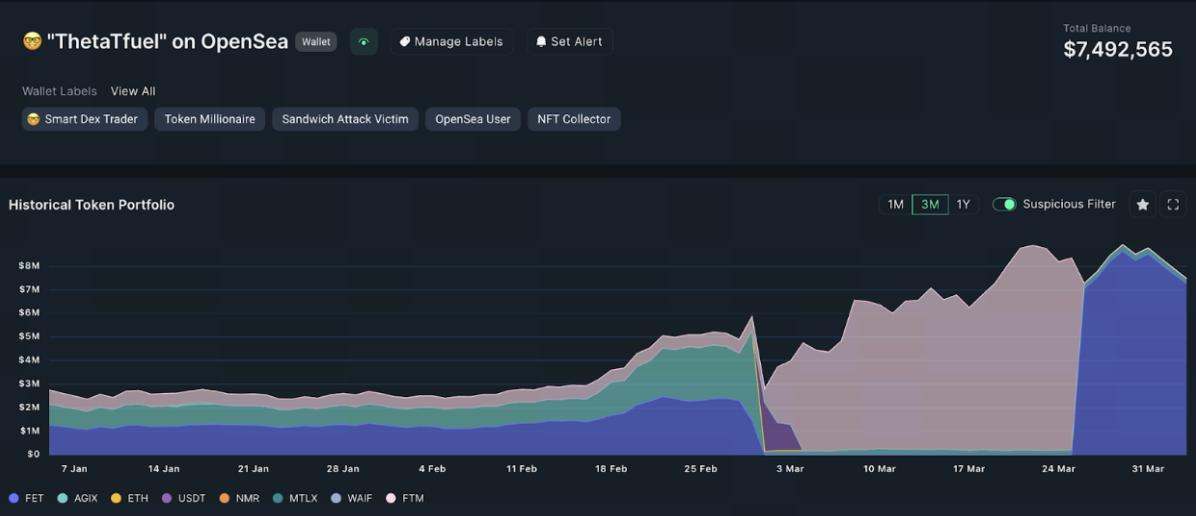

Nansen Tool Shows Smart Money Involvement in Transactions (Source: Nansen)

Nansen also clearly shows token funding flows for a specific wallet address. This makes it easy for users to visually analyze whether the smart money is staying in a particular project or ecosystem, or whether it is pulling funds from specific sectors.

Nansen Shows Funding Flow for a Specific Address (Source: Nansen)

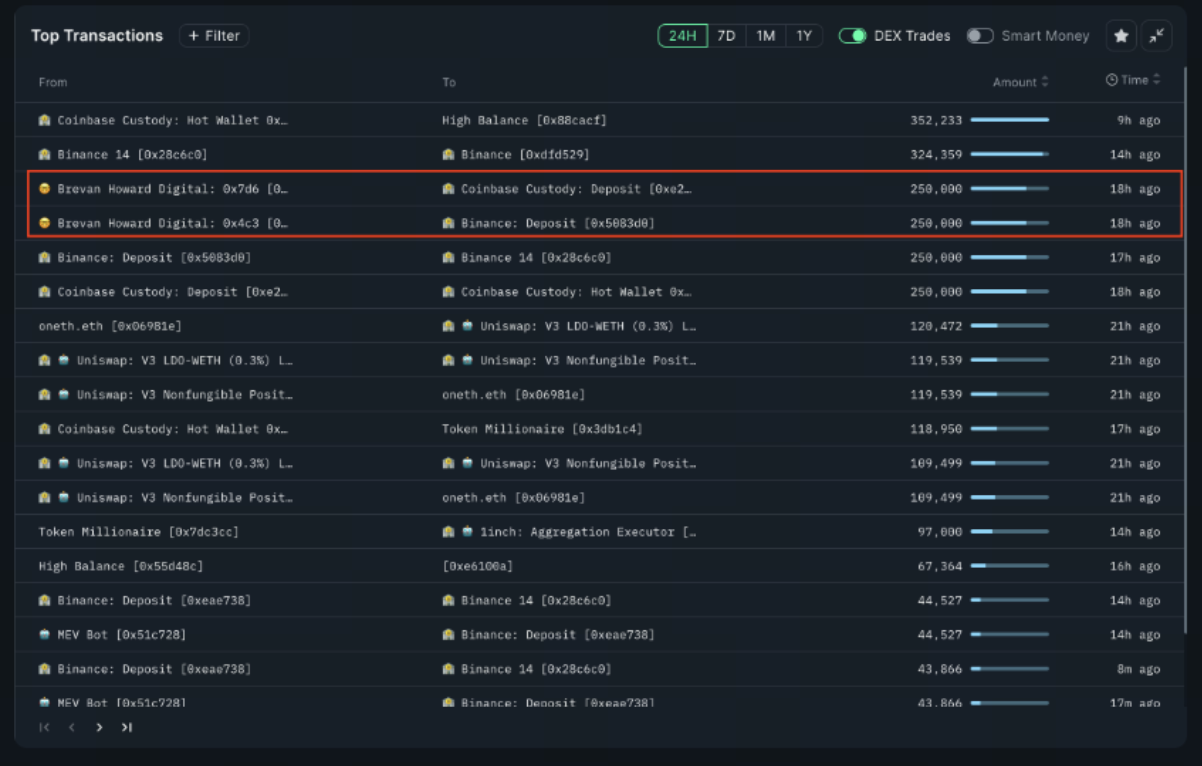

In altcoin investments, factors such as institutional ownership rates, token unlock schedules and whether these tokens are transferred to exchanges are among the important factors that affect short-term price volatility. For example, as the unlocking of tokens allocated to VCs or early investors in a project approaches, Nansen can tag these addresses and track on-chain transfer activity. If a large number of transfers occur from these addresses to exchanges, this could be a potential sell signal for investors for arbitrage purposes. This could serve as an early warning for traders to reduce their positions or update their strategies.

Nansen Shows Large Token Transfers to Exchanges (Source: Nansen)

Other On-Chain Tools

DeBank allows users to search for any Ethereum address to examine the assets and past transaction activity of that wallet. If you know the wallet address of a well-known investor, you can add it to the DeBank watchlist to track the wallet’s current asset allocation and returns.

Etherscan is a blockchain explorer used to drill down into on-chain transfers. When the price of a token fluctuates, you can check if there are large transfers for that token on Etherscan; by tracking funds going from a wallet to an exchange, you can analyze whether large investors are selling.

Smart Money Tracking Strategy

Whale Sale Warning

In March this year, AUCTION, a DeFi platform token, suffered a sudden price drop of 50 percent. According to Lookonchain’s official X (Twitter) account, several whale wallets transferred a total of 1.08 million AUCTION tokens (about %14 of the circulating supply) to centralized exchanges such as Binance and OKX just before this drop. Such a large movement of tokens to exchanges was a clear indication that whales were preparing to sell, causing the price to collapse.

If these wallets were monitored in advance, unusually large transfers could have been detected and early action could have been taken (e.g. closing positions, implementing hedging strategies). Smart money tracking strategies strengthen risk management by catching such turn signals in time. Conversely, if whales start to show strong interest in a token that was previously silent, this could be a sign of positive developments (e.g. a protocol update or new product launch). This could create an early entry advantage for investors.

Understanding the Intentions of Smart Money

Not all whale activity should be followed blindly. It is necessary to analyze the strategic purpose behind smart money. Some whales belong to prestigious institutional funds and make long-term investments in high-potential projects. These addresses usually trade at low frequency, but their movements carry important signals for understanding the market trend.

Some whales are known as “liquidity pool opportunists”. These arbitrage addresses, which collect large amounts of tokens from newly opened pools and make serious profits in a short time, can be followed especially for short-term buy and sell strategies. But keeping up with the speed of these wallets is difficult for most investors.

Also, some so-called “smart money” addresses may actually have made big profits through random chance. For this reason, it is important to filter out addresses that really act based on knowledge and strategy. Instead of blindly following these addresses, it is necessary to treat them as signal sources and make final decisions based on your own analysis and risk management.

On-chain tools can offer insights into the direction of market-leading funds. But there is no guarantee that no whale will make a mistake. Smart money tracking should therefore only be used as a reference and should always be supported by your own fundamental and technical analysis. Diversifying information is the key to true investment awareness.

Combining Three Methods to Create a Personalized Strategy

The altcoin market is constantly changing and there is no single formula for success that works for everyone. However, the three fundamental analysis methods - fundamental analysis, technical analysis and smart money tracking - are powerful tools that complement each other:

• Fundamental analysis determines which projects offer long-term potential.

• Technical analysis offers the advantage of timing in determining when to enter or exit a position.

• Smart money tracking provides clues to the trends of traders who move early in the market.

Using these methods together significantly increases the chances of success. For example, you identified a DeFi project with strong fundamentals, you saw a positive pattern on the chart, and at the same time multiple whales entered this project - this triple combination indicates a strategic opportunity with high potential.

Conversely, entering a weakly based coin that the whales have already abandoned by relying solely on a technical buy signal is a risky strategy that could end in failure.

The investor profile may vary according to the individual.

• Some deepen in fundamental analysis by analyzing sector trends.

• Some prefer to trade with technical indicators.

• Advanced users take advantage of whale movements by specializing in on-chain data analysis.

The important thing is to learn these tools, practice and over time build your own successful combination of strategies.

Ask these three questions when evaluating your investments:

- What is the long-term value of this project? Fundamental Analysis:

- Is the current market trend and sentiment appropriate? (Technical analysis)

- Are whales interested in this token? (Smart money tracking)

Once you have clear answers to these three questions, your investment decision will be more grounded.

Finally, a reminder: No matter how confident you are, risk management should not be neglected. Set stop-losses on every trade, manage your position size and diversify your portfolio. In the long run, these principles will keep you afloat, allowing you to capitalize on profit opportunities.

I wish all investors to navigate the crypto world with knowledge, strategy and patience!

Related Articles

What is HyperGPT (HGPT)?